Understanding Per Diem Rates: A 3-Minute Breakdown

Business travel should be a chance to productively connect with colleagues or clients and maybe even explore a new city. Companies play a huge role in empowering their employees to make the most of business trips, whether by providing an efficient booking process, helping to ensure high safety standards for traveling employees, or setting per diem limits that empower business travelers to nourish themselves and their peers on the go.

Here’s a primer on what per diem means, how companies can define it, its relationship with the expense process and a company’s finances, and its effect on the holistic business travel experience.

What does per diem mean?

Business travelers hitting the road for the first time are tasked with learning a new lingo regarding employee travel. For example, there’s “bleisure,” a term used to define extended business trips that mix in some leisure, and "TMC," which refers to the business travel management companies responsible for handling the logistics.

But few buzzwords affect the traveler’s daily life more than “per diem.” Per diem refers to the daily allowance or amount a company designates for business travelers to cover costs incurred on corporate trips. This can include transportation, hotel, meals, and incidental expenses.

Where does the term “per diem” come from?

The phrase “per diem” comes from Latin, meaning “by the day.” Many languages use the same Latin phrase.

In addition to referring to daily allowances for expense reimbursements related to a specific business purpose, per diem can also be used as an adjective. In that case, it means someone is paid a fixed amount per day, as in, “This is a per diem position.”

It can be used in the context of workers who work on an “as needed” basis and earn a daily rate, such as substitute teachers. Per diem employees are called in to work when needed and get paid for each day instead of full-time positions with benefits like healthcare.

The first records of “per diem” being used in English come from around 1500, according to Dictionary.com; its first recorded use as a noun referring to a daily allowance dates to the 1800s. For the purposes of this article, we are referring to the latter definition, which refers to business expenses that fall under a per diem policy — not part-time or per diem work.

How do employers define per diem rates?

Depending on the employer, per diem expenses can be broken down in several ways.

Some business travelers might have

Other employers use a

Why do per diems exist?

Per diems are set because designated travel expenses become tax-deductible business expenses. Typical tax-deductible business travel expenses include all transportation, including planes, trains, buses, and rental cars, as well as short-term trips with taxis or rideshare apps. They also include fees for checking baggage, meals, lodging, and incidentals.

What is the standard per diem?

While every organization’s per diems vary, the U.S. General Services Administration publishes a per diem rate guide each year that outlines rates for several cities in the United States. While these standard rates generally apply to federal employees, private companies can use the information as a starting point.

According to 2025 GSA rates, the standard per diem rate in the U.S. is $178, including $110 for lodging and $68 for meals and incidental expenses (M&IE). Of the 26,000 counties included, 319 have per diem rates higher than the standard rate.

For example, the per diem rate in San Francisco, a high-cost city and popular business market, maxes out at $424, including $345 for lodging and $79 for M&IE during peak travel months such as January, February, or March.

These are typically the busiest months for business travel. The federal government even details per diem payments for the first and last days of travel, which they calculate at 75 percent of a full travel day.

For the five boroughs that make up New York City, the standard per diem rate maxes out at $365, including $286 for lodging and $79 for meals and incidental expenses during September, October, or November.

How does GSA calculate the standard per diem?

These per diem rates are based on an area’s cost of living. Per diem rates in large cities, such as Chicago, New York, and Los Angeles, are higher than in less urban areas because goods and services in larger cities are usually more expensive.

Interested in per diem rates for your area? You can search by city or zip code on the GSA website.

GSA only sets per diem rates for the 48 contiguous states of the continental United States. The Department of Defense Travel Management Office sets daily allowances for Alaska, Hawaii, and U.S. Territories, while the Department of State sets per diem rates for foreign destinations.

What are some per diem guidelines?

Business travel is a strategic lever for growth. When handled correctly, it can build employee morale and commitment; therefore, it’s in a business’s interest if its employees look forward to travel opportunities.

Employers can improve the business travel experience by taking the following steps:

- Set a generous, or at least fair, per diem amount.

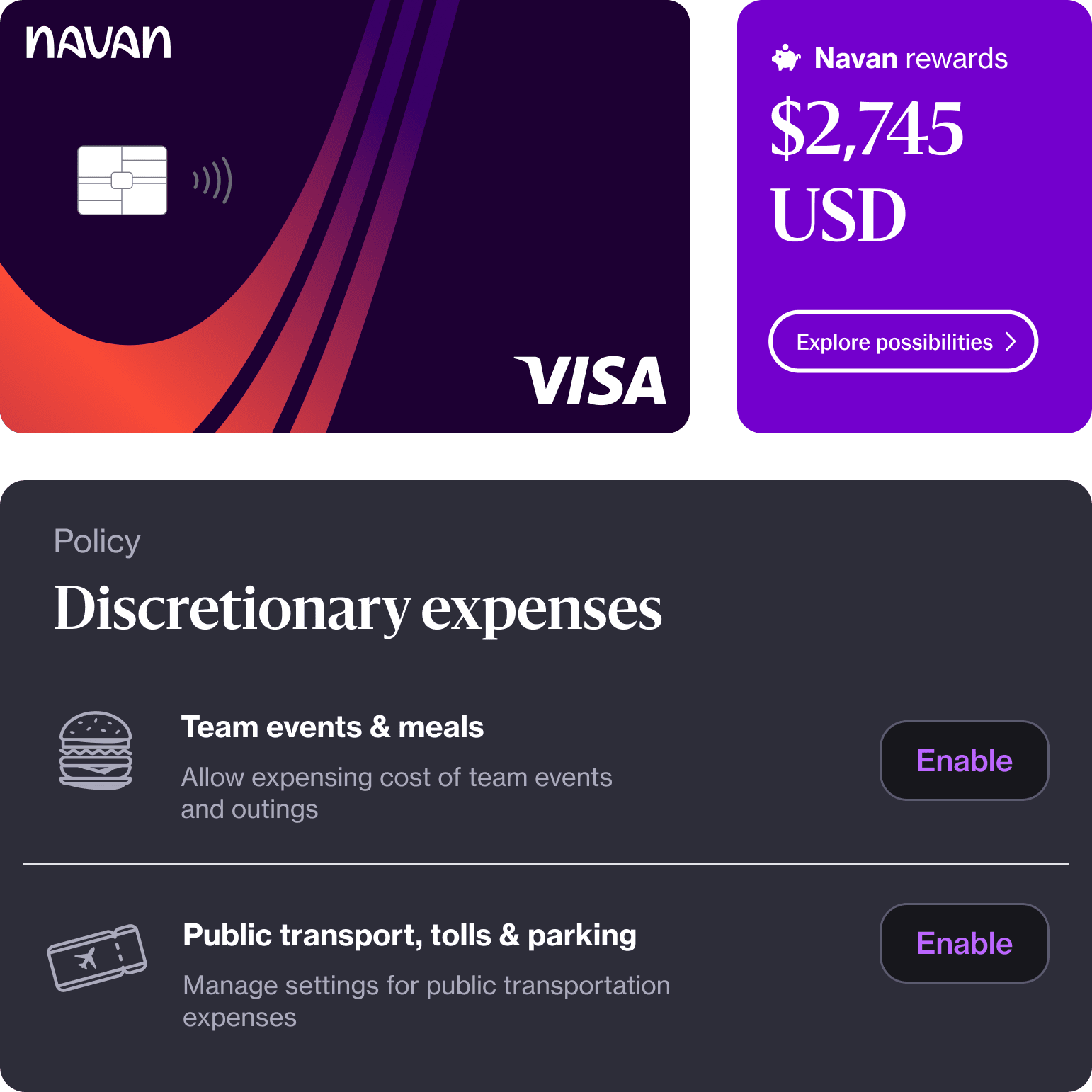

- Provide corporate credit cards for expenses so employees aren’t pulling from their taxable income.

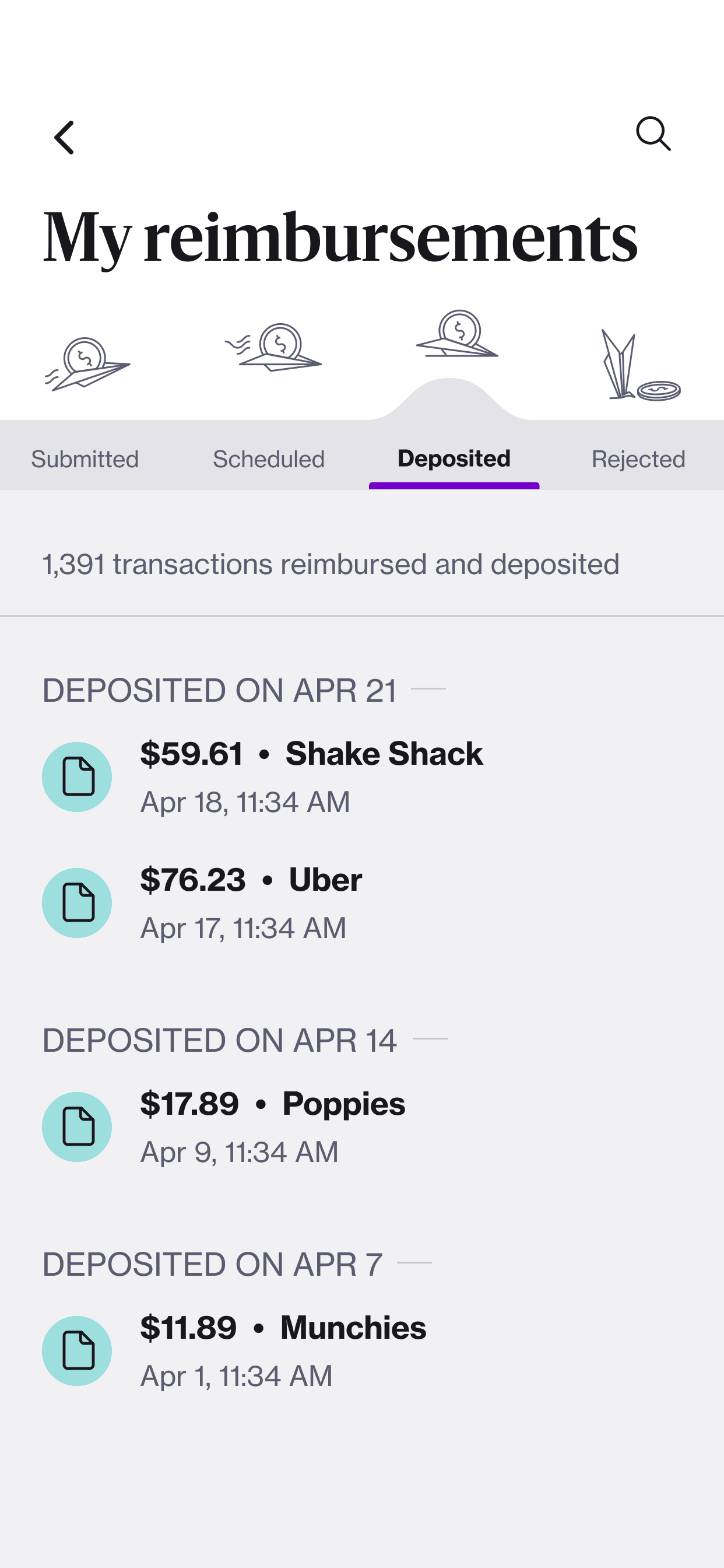

- Automate the expense report and per diem reimbursement process with smart technology.

- Make per diem policies actionable upon card swipe, so employees don’t have to memorize a handbook of actual expense amounts or allowed lodging rates.

- Support travelers’ safety and security with a high duty of care embedded in the travel policy.

- Make the booking and travel support process as enjoyable and efficient as possible.

All of this, and more, is possible when partnering with a modern travel and expense management company that leverages the latest technology and innovation to craft a holistic, 360-degree travel experience — from booking to expense reports.

Learn more about how Navan makes business travel better — including how to eliminate the need to submit traditional expense reports after making the most of the per diem.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.