The New Role of Modern Finance Leaders

Samantha Shankman

The Modern Role of Finance Leaders: A Strategic Evolution

Long gone are the days when finance leaders were simple number crunchers. Their role has evolved into a much more strategic one, driven by advancements in automation and technology. Team members across the finance organization are now focusing on strategic planning, decision-making, and driving business success.

The rise of automation in financial operations has not only redefined the responsibilities of finance teams, but also of Chief Financial Officers (CFOs); everyone has been empowered to deliver more actionable insights and to optimize financial performance.

The Evolving Role of Finance Leaders

According to an Asana survey, office workers spend 60% of their time on busywork and only 33% on the job they’re hired to perform. The survey found that employees spend just 13% of their time on strategic work.

Finance leaders are not immune from this plague. Traditionally, finance leaders were tasked primarily with maintaining financial records and generating reports. But now, the role of the modern CFO encompasses a broader spectrum of responsibilities.

Today, finance leaders are pivotal in shaping the strategic direction of their organizations. They provide valuable insights that influence decision-making across the C-suite and help steer the company toward financial success. This shift underscores the importance of solid finance leadership within business leaders’ ranks.

Why has the change occurred? For starters, automation has revolutionized the finance function by taking over repetitive, manual tasks. This shift allows finance teams to concentrate on higher-value activities such as forecasting, risk management, and financial planning.

By streamlining financial processes, automation enhances the efficiency and accuracy of financial operations, leading to improved economic health and profitability. As automation advances, the job title of CFO now encompasses a blend of strategic vision and operational oversight.

Key Responsibilities of Modern Finance Leaders

The key responsibilities of modern finance leaders today include strategic planning, decision-making support, stakeholder management, risk management, and sustainability initiatives.

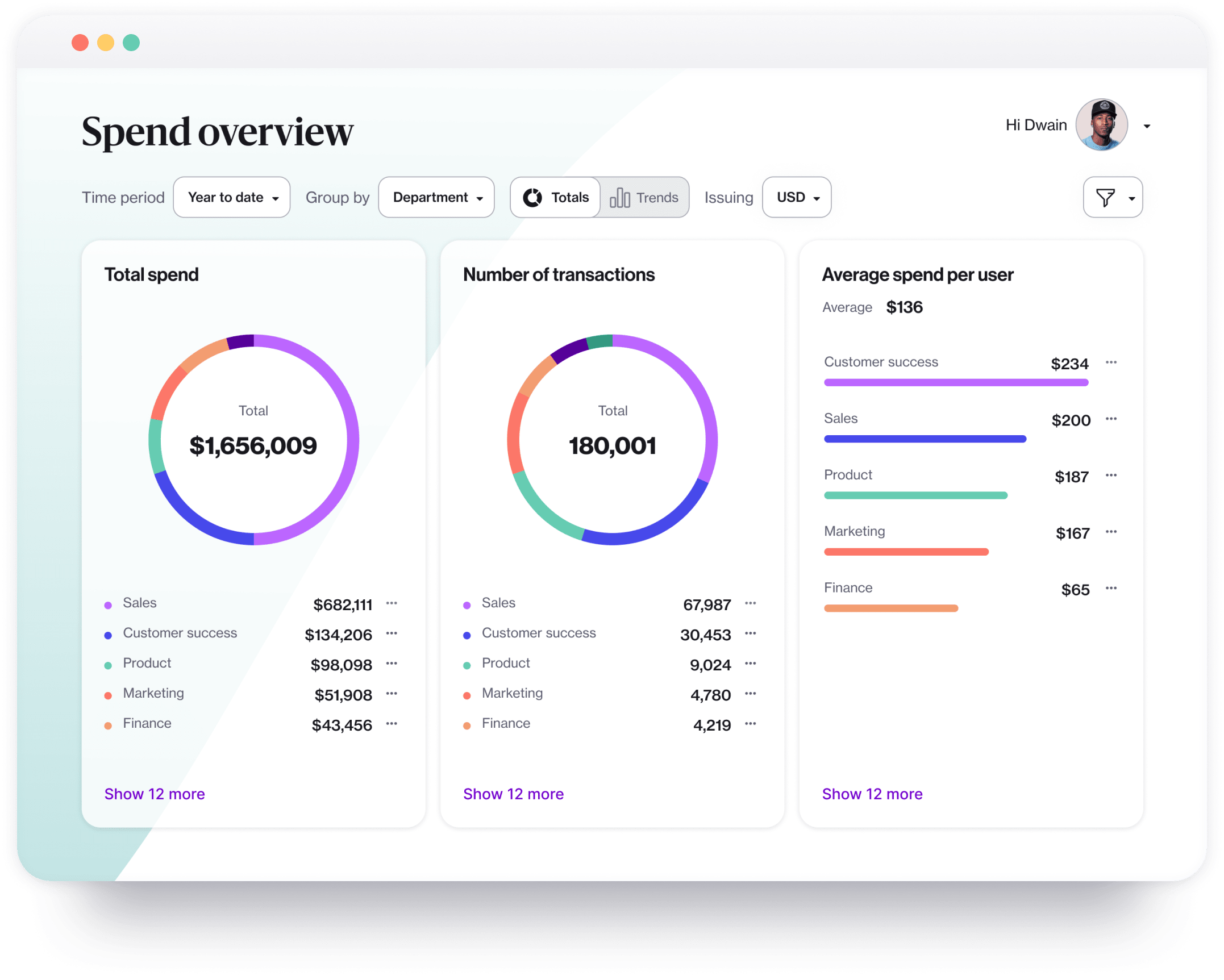

Modern finance leaders utilize advanced analytics to transform financial data into actionable insights. This capability enables them to predict future trends, optimize pricing strategies, and enhance economic performance. By leveraging financial data, CFOs can provide the C-suite with critical insights that drive strategic initiatives and business growth. This improved decision-making ability is a testament to the evolving role of finance leadership teams and the effect it’s having on today’s business landscape.

That effect is a powerful one. Integrating real-time data analytics into financial operations and metrics lets finance leaders quickly make informed decisions and respond swiftly to market changes and operational challenges.

Even financial reports — cornerstone of strategic planning — have been transformed. With automation, generating these reports has become a much more efficient process. Automated financial reports provide timely and accurate insights into the company’s financial health, enabling finance leaders to make data-driven decisions.

“The bottom line is that efficiency drives success. Our front office employees now allocate fewer hours to paperwork, enabling them to focus more on winning customers and delivering world-class service.”

- Hayden Stafford, President and Chief Revenue Officer, Seismic

Read more about how Navan helped Seismic boost efficiency.

Digital Transformation in Finance

The digital transformation sweeping across industries has had a profound impact on the finance function, particularly when it comes to expense management. This transformation represents a shift for finance leaders — from traditional, labor-intensive processes to a more streamlined, automated approach. This digital shift enhances the efficiency of financial operations and allows finance leaders to focus on strategic goals rather than getting bogged down in routine tasks.

Digital tools and platforms automate the expense management process, from transaction tracking to reconciliation. This automation reduces the time and effort required for manual data entry and processing; it also minimizes errors and improves accuracy. As a result, finance leaders can spend more time on financial planning and analysis (FP&A), strategic planning, and making informed financial decisions that drive business growth.

Benefits of Digital Transformation for Financial Leaders

- Improved Efficiency: Automation of routine tasks frees up time for finance leaders to focus on strategic initiatives.

- Enhanced Accuracy: Digital tools reduce the likelihood of human error, ensuring more reliable financial data.

- Real-Time Insights: Access to real-time financial data allows for better decision-making and forecasting.

- Scalability: Digital platforms can quickly scale to accommodate the needs of growing businesses, making them ideal for organizations undergoing mergers or expansion.

Navan Expense: Empowering Finance Leaders

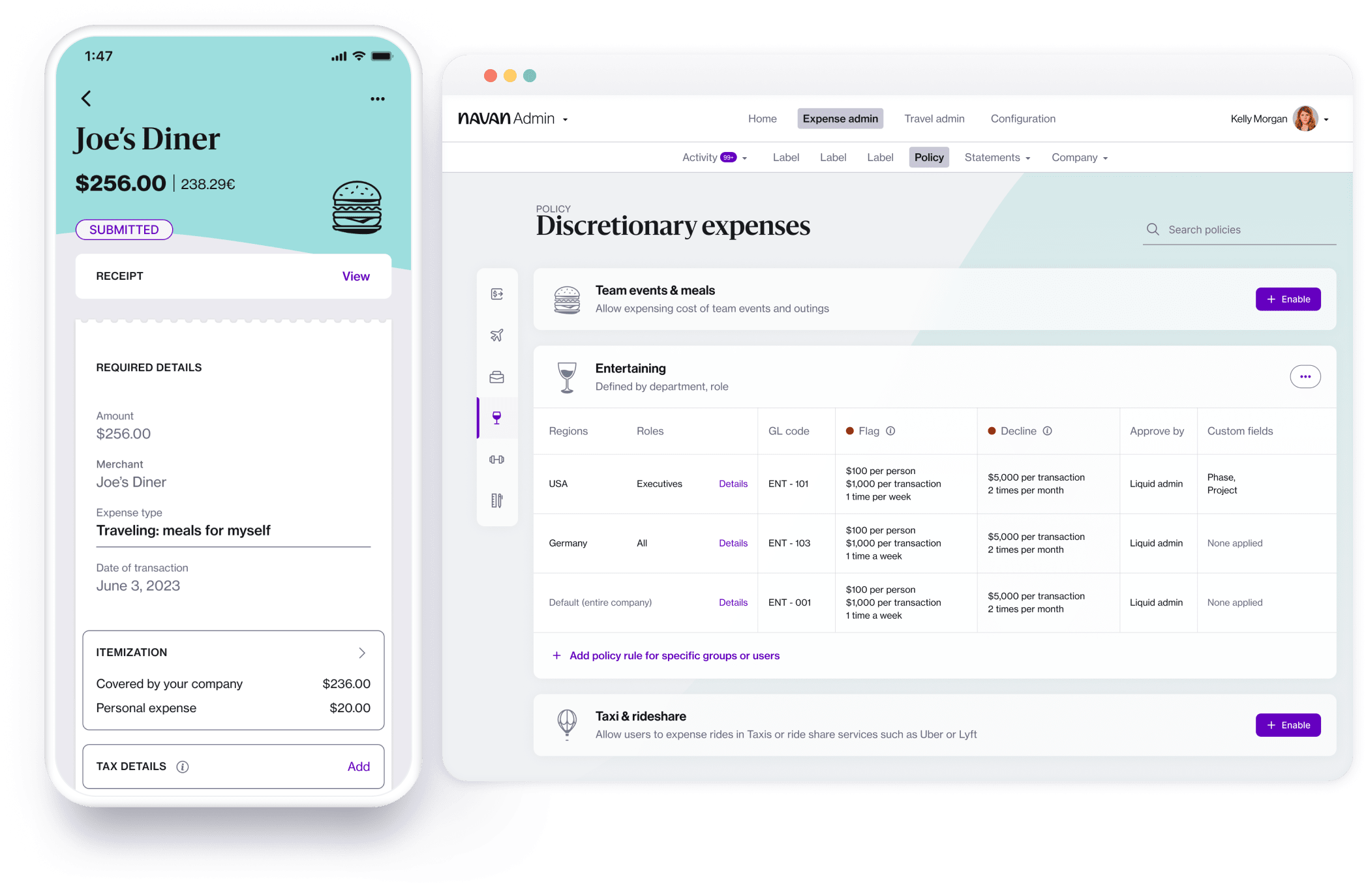

Navan Expense is an expense management solution that streamlines business financial operations by automating the expense management process from swipe to reconciliation, which helps finance leaders save time and resources. The Navan solution offers customizable spending controls, real-time visibility into spend, and seamless integration with existing financial systems.

And now, companies don’t even have to give up their existing corporate cards to reap the benefits of Navan Expense. They can simply link their current corporate cards to Navan and get real-time visibility and policy enforcement for their company’s enrolled Mastercard® or Visa® corporate card.

What is Navan Connect?

Navan Connect is an innovative card-link technology that allows businesses to enjoy all the perks of automated expense management without switching from their current trusted bank cards.

How Navan Expense Supports Finance Leaders

Navan Expense empowers finance leaders by providing tools that enhance efficiency and accuracy in expense management. Here’s how it helps:

- Automation of Expense Reports: Navan Expense eliminates the need for manual expense report submission and approval, reducing the administrative burden on finance teams.

- Real-Time Spend Visibility: Finance leaders get real-time insights into company spend, allowing for more accurate budgeting and forecasting.

- Customizable Spend Controls: With preset spend policies, finance leaders can control spending before it happens, ensuring adherence to budgets and policies.

- Seamless Integrations: Navan Expense integrates with major accounting systems, streamlining the reconciliation process and improving overall financial management.

“"Instead of worrying about the administrative burden that expense reports can bring, employees are focusing on their work."”

- Diana Ciccolini, Sr. Manager of Accounting, Quickbase

Read more about how Quickbase reduced manual expense approvals by 70% with Navan Expense.

Using Navan Expense enables finance leaders to focus on strategic goals by automating routine and time-consuming tasks. Traditional expense management requires significant manual effort, from submitting and approving expense reports to reconciling accounts. Navan Expense streamlines these processes, allowing finance leaders to dedicate more time to strategic initiatives that drive business growth.

By removing the burden of routine tasks, finance leaders can better focus on long-term financial planning and value-added activities that enhance the organization’s economic health.

Moreover, Navan Expense provides enhanced decision-making capabilities through real-time data and actionable insights. The platform offers finance leaders a comprehensive view of company spend as it happens, enabling them to make informed decisions quickly. This immediate access to financial data supports more accurate budgeting and forecasting, allowing finance teams to anticipate challenges and seize opportunities.

With Navan Expense, finance leaders can respond swiftly to market changes and operational demands, ensuring the organization remains agile and competitive.

Another critical benefit of Navan is an improvement in a company’s overall financial health. Navan Expense ensures that finance leaders have accurate and timely financial data, which is essential for effective cash flow management and profitability analysis. The platform’s real-time visibility into spending patterns helps identify cost-saving opportunities and areas where resources can be allocated more efficiently.

This proactive approach to financial management leads to better control over financial performance and contributes to the company’s economic stability and growth.

Additionally, Navan Expense supports organizations in their broader digital transformation efforts. By integrating advanced automation and data analytics into the finance function, Navan Expense enhances financial operations' overall efficiency and effectiveness. This alignment with digital transformation goals streamlines processes and fosters a culture of innovation and continuous improvement within the finance team.

As a result, finance leaders are better equipped to drive financial leadership and navigate the complexities of today’s dynamic business environment.

“Navan saves me an immense amount of time. During our first monthly close, I pulled the data from Navan and uploaded it to our ERP in less time than it used to take me to distribute everybody’s statement.”

- Robert Oden Jr., Staff Accountant, The Penn Group of Companies

Read more about how Penn Group reduced reconciliation time by 73% with Navan.

Navan Expense empowers finance leaders to transition from traditional roles to strategic advisors. By automating routine tasks, providing real-time insights, improving financial health, and supporting digital transformation, Navan Expense offers a comprehensive solution that addresses the challenges faced by modern finance teams. For finance leaders looking to enhance their strategic impact and drive business success, Navan Expense presents a compelling option that aligns with the evolving demands of the finance function.

But don’t just take it from us. Read about how these companies benefited from Navan Expense:

- 1E: 160 hours per month saved on expense management

- United E&C: <1 hour reconciliation process

- Asana: 98% of purchase card transactions auto-approved

- Flock Safety: 40% reduction in transactions flagged for review

- 8x8: 100% of expenses paid with Navan Expense

Next Steps

The role of finance leaders has evolved significantly, driven by automation and the increasing strategic demands of the business environment. Modern finance leaders are strategic advisors who leverage technology to provide actionable insights, optimize financial performance, and drive business success. As the landscape continues to evolve, the strategic role of finance leaders will only become more critical, making their contributions indispensable to the overall success of their organizations.

Modern finance leaders are shaping the future of their organizations by focusing on strategic planning, leveraging automation, and driving business growth. As technology continues to advance, the role of the CFO and finance teams will undoubtedly expand, offering new opportunities to enhance financial leadership and achieve greater financial success.

Download the Expense Management Time-Saver’s Reading Kit to optimize your workday.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.