13 Reasons Why Navan Is the Perfect T&E Solution for Small Businesses

There is an invisible current that runs through start-ups and small businesses that has a silent but outsized impact on their success. It is the tools, operations, and processes that keep their books in check, their employees safe and happy, and their teams focused on strategic goals rather than manual minutia.

In fact, the technology and policies behind small businesses’ travel and expense programs can either supercharge or hinder teams’ growth. However, many founders, CEOs, and finance leaders don’t fully realize all of the benefits an upgrade can offer.

Navan, the all-in-one modern travel, card and spend solution, streamlines and optimizes this essential process so executive teams can focus on what they do best: creating, building, and running their businesses.

The Navan and Navan Expense solution work perfectly for small- and medium-sized businesses across the United States and Europe that want to empower their employees to spend money and travel without losing the visibility and control that’s essential to their survival.

13 Reasons Why Small Businesses Turn to Navan

1. All-in-one modern solution

Navan is an all-in-one modern solution that centralizes all data and operations into one seamless UX. Businesses won’t waste time mixing and matching solutions when one tool can expertly manage all travel and spend management tasks.

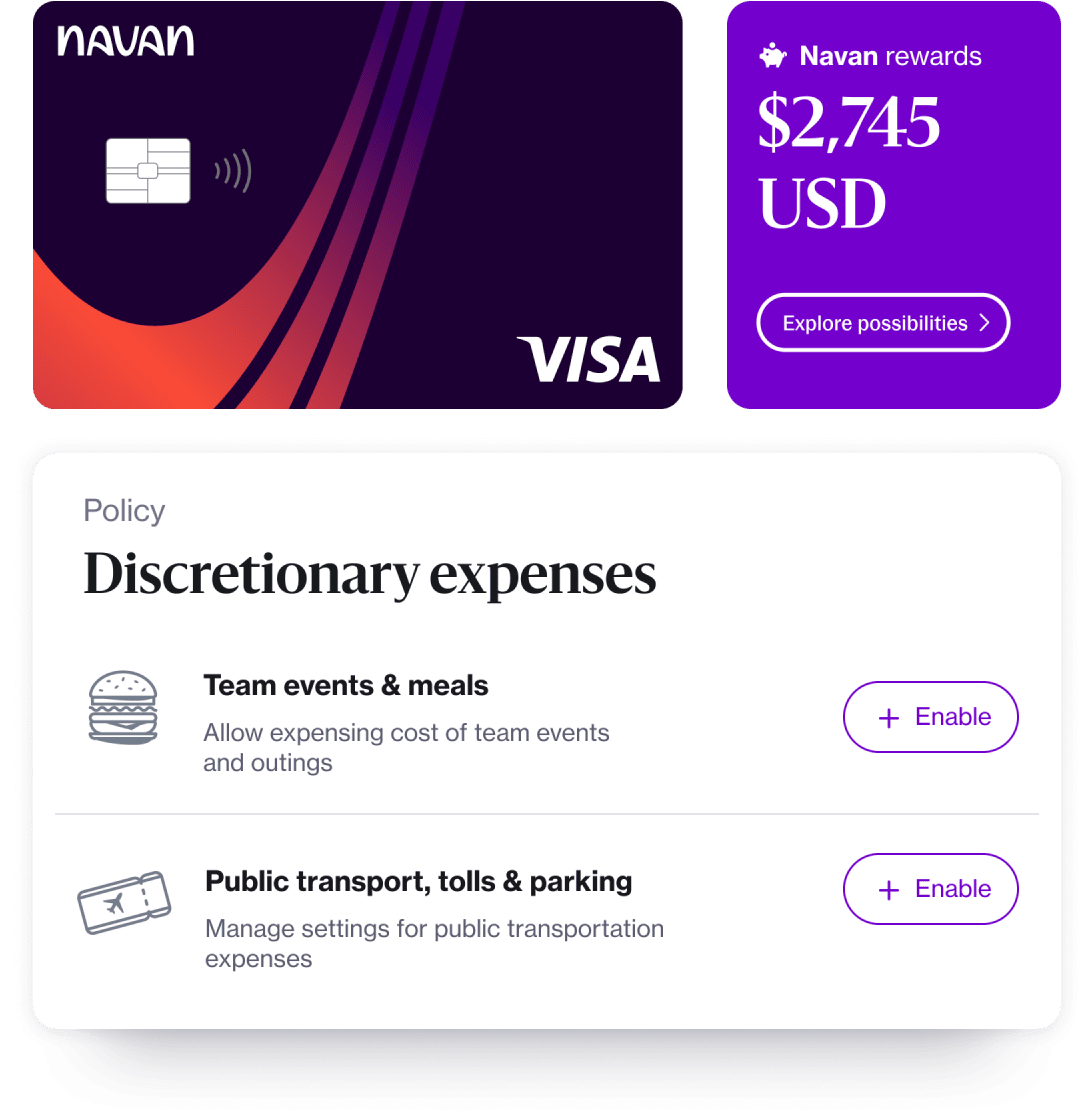

2. Smart corporate cards

Smart corporate cards give employees a simple way to pay for what they need via physical or virtual cards for spot purchases, recurring software subscriptions, marketing spend, travel spend, and more.

3. Powerful spend controls

Powerful spend controls

4. Higher limits and easy onboarding

With higher limits and easy onboarding, founders and leadership teams can focus on growing their business. A Navan launch manager can help onboard the whole company in days, and business leaders can issue virtual and physical cards to anyone who needs them in one click.

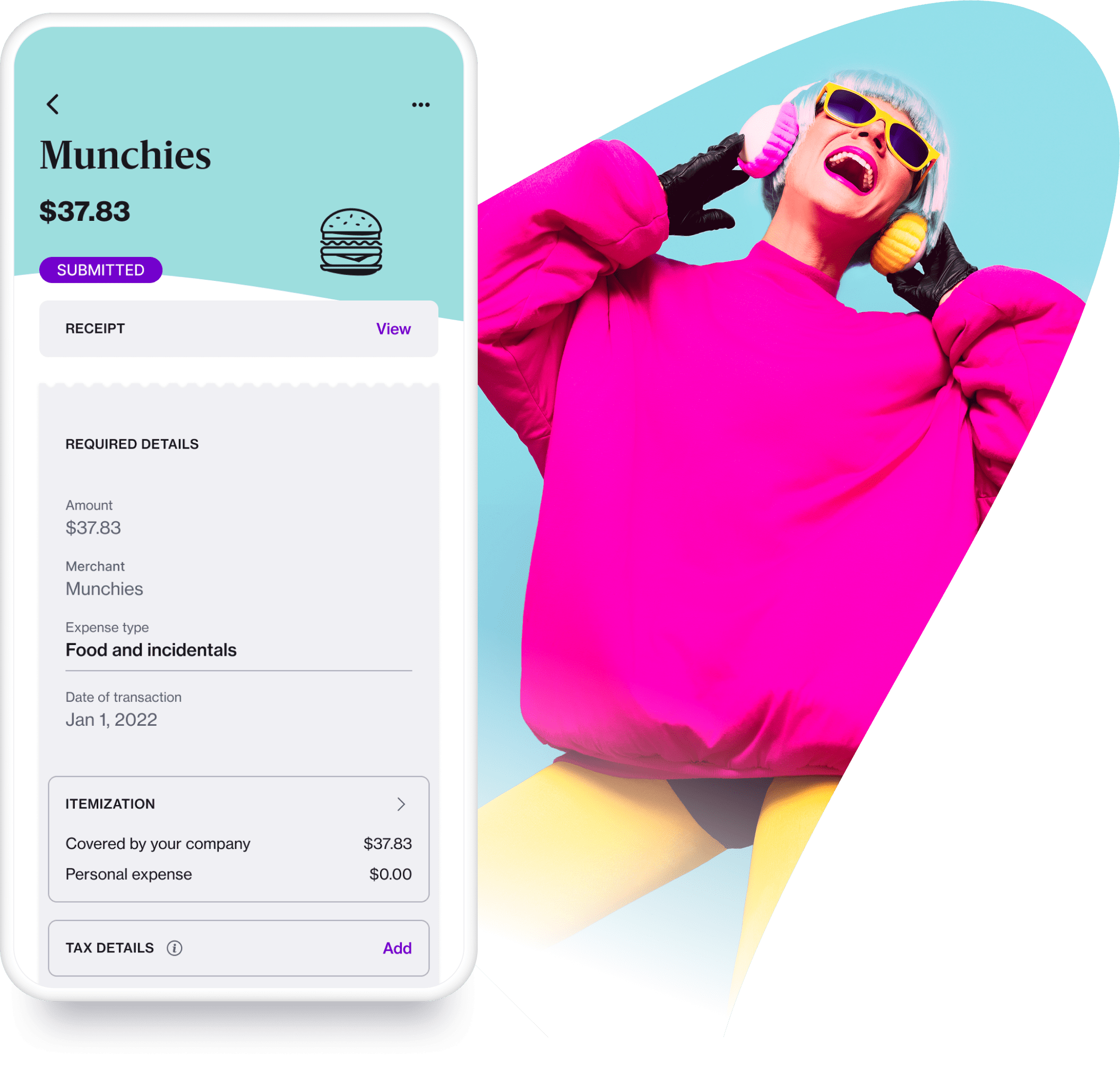

5. Automated accounting

Automated accounting accelerates month-end close, with receipts and payment details captured automatically at the point of sale—slashing the time required for the reconciliation process from days to minutes. Navan Expense also auto-categorizes transactions and integrates directly with ERP and accounting software like NetSuite, Sage, and QuickBooks.

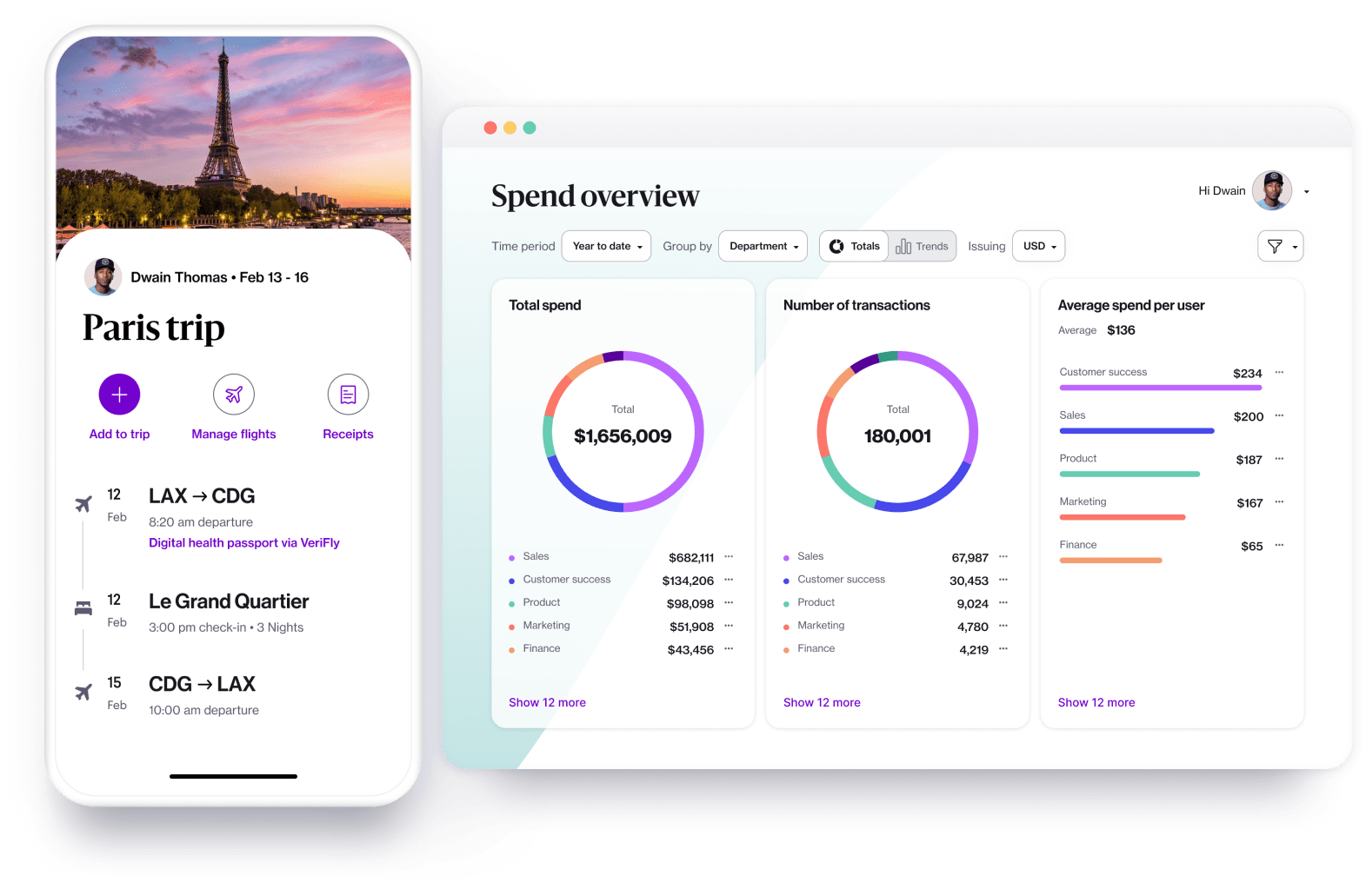

6. Real-time spend visibility

Real-time spend visibility offers a consolidated view of all business spend in one place, in order to drive smarter decisions on savings and efficiencies. Interactive dashboards provide an instant, centralized view of spend; plus, data be sliced and diced with unprecedented granularity.

7. Easy-to-understand dashboards

Easy-to-understand dashboards, so employees at all levels are able to interpret and understand the data.

8. Increased time and cost savings

from operational efficiencies and productivity (automated reconciliation, elimination of expense reports, cashback). This also frees up teams for more strategic work.

9. Vendor consolidation

Vendor consolidation allows a business to simplify its vendor stack, going from smart corporate cards, spend management, and reimbursements to a full-service, all-in-one business travel management platform.

10. Mobile apps

Mobile apps provide a seamless UX for travel and spend management, empowering everyone from admins to employees to complete the same tasks on mobile as desktop.

11. Access to enterprise-level deals

Access to enterprise-level deals on travel, so your team can focus on in-person connections and making deals rather than searching for the cheapest fares.

12. Fraud protection and security

Fraud protection and security ensure that company cards are never misused and that funds aren’t lost or mishandled in a growing organization. With Navan, leadership can set the policy and then forget it, knowing that the technology will auto-enforce it.

13. Better employee experience and satisfaction

Better employee experience and satisfaction

Essential reading:

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.