Why More Companies Are Turning To Expense Automation

Delivery apps. On-demand entertainment. The world today moves at the pace of immediacy. But not every industry has caught on as quickly as others — the expense management process, for instance, consistently lags behind.

It involves chasing receipts, compiling spreadsheets, and slogging through monthly reconciliations, only to find errors in need of correction. The key to making these processes more efficient is expense management automation.

What is Expense Management Automation?

At its core, expense automation is the use of modern technology to streamline the recording, tracking, and approving of expenses incurred by employees for business-related needs.

However, how this manifests from company to company will vary greatly depending on their financial operations.

When expense management automation is deployed efficiently, finance departments can streamline workflows to eliminate wasted time on manual data entry.

The Pains of Legacy Solutions

Many companies currently host technology stacks for expense-related processes. However, a lack of transparency and synergy in these systems means many financial leaders are unaware of how many hoops a transaction goes through for reconciliation.

Here are the three main pain points of using legacy solutions:

The Journey of a Single Receipt Through the Legacy Process

Below is the tedious trek of one receipt in a traveler's journey:

- Receipt collected: An employee collects a paper receipt while traveling.

- Manual report: They upload the receipt data into a spreadsheet expense report for the next cycle.

- Policy review: A finance, accounting team member, or supervisor reviews the report for policy compliance.

- System upload: The accounts payable team uploads the expense report to the accounting system.

- Verification: The submitted receipt is then verified as legitimate.

- Filing: All receipts from the expense cycle are filed for tax and accounting purposes.

- Tax coding: The correct tax codes associated with the transactions are entered into the report.

- Final Upload: The report is uploaded to the company’s accounting system or ERP for auditing and recordkeeping.

- Reimbursement: The employee is reimbursed for the out-of-pocket expense via the next payroll disbursement, depending on when it was submitted.

Phew, did you get all that?

The Automated Possibilities of Expenses

With the number of modern solutions available to companies today, there is no reason for the expense reporting process to be so complicated.

According to a survey by the Global Business Travel Association (GBTA), 49% percent of travel buyers find that setting up expense reports to be a substantial pain point. That’s a lot of time and money wasted when more significant tasks are at hand, like growing a company. Some key features of automated expense management systems include, but are by no means limited to:

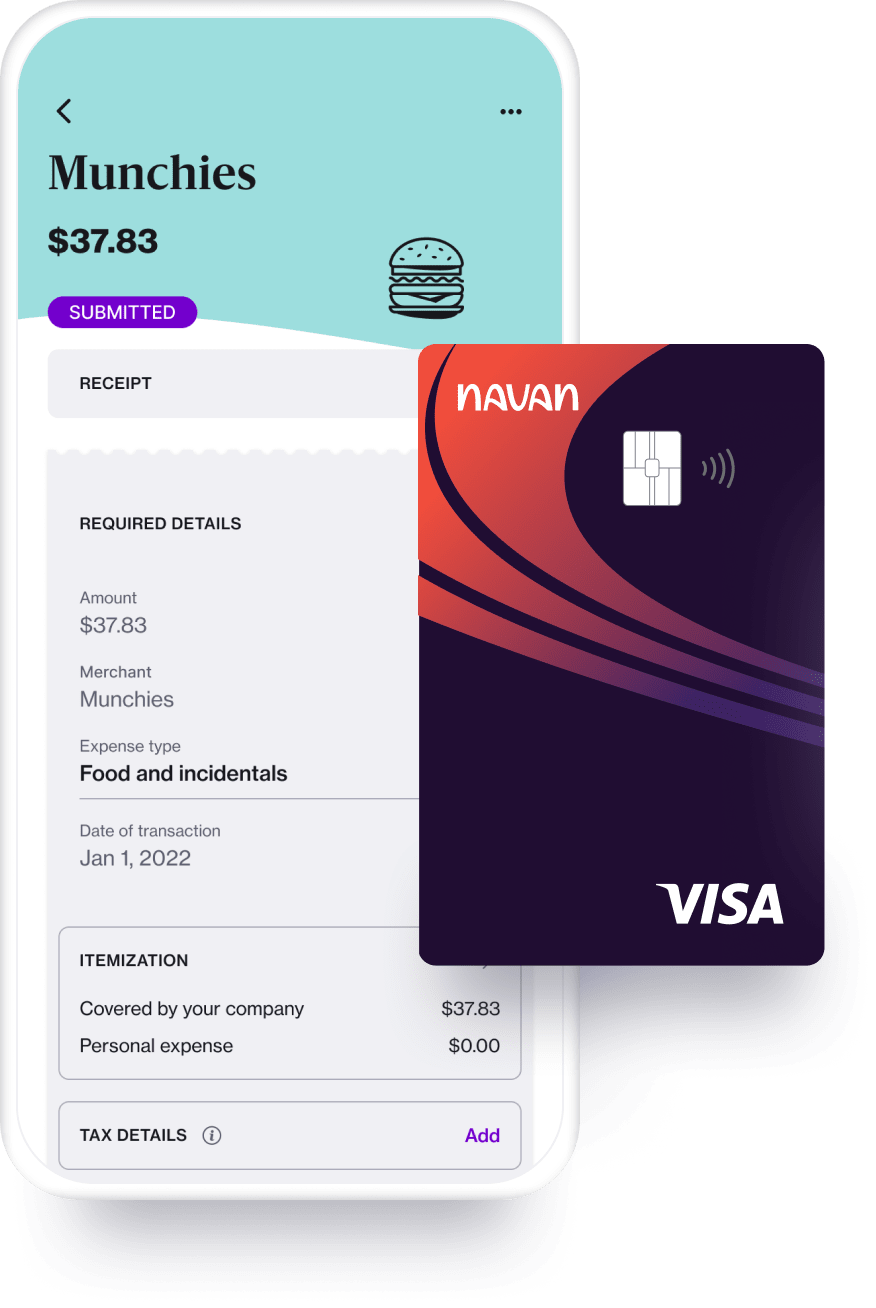

- A streamlined path for employees to submit and manage their expenses

- A process for submitting business expenses from anywhere worldwide via a desktop or mobile app.

- Real-time expense data extraction for business-related transactions that simplify filing systems.

- Immediate notifications for finance teams if expense policies are violated.

- Direct ERP and accounting system integrations that immediately connect across tech stacks.

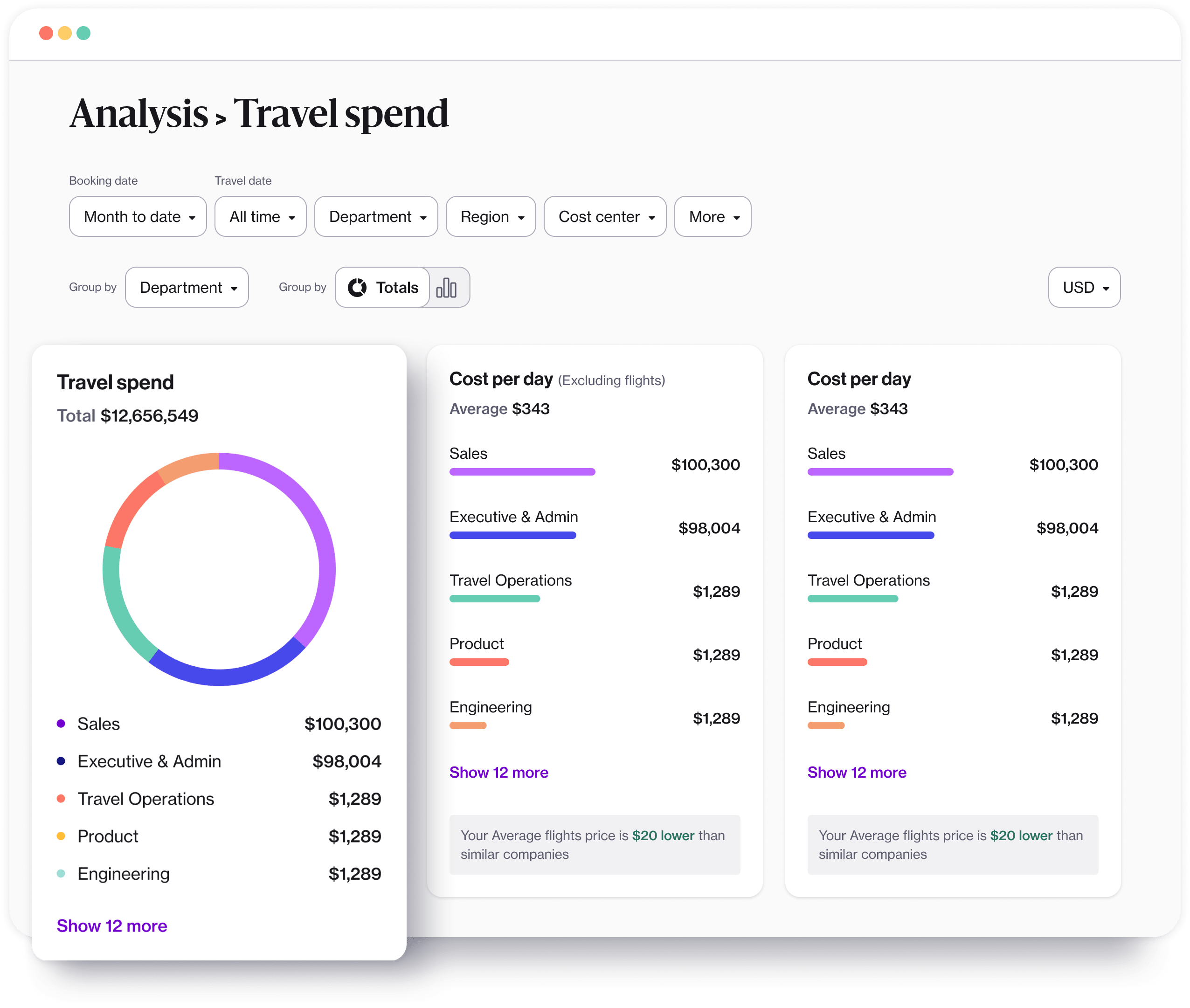

- Granular-level data reports for company spend tracking and budget control.

- Auto-approved expense reimbursements put money back into employees’ hands faster and increase trust and satisfaction if out-of-pocket expenses occur.

But where else?

Make Auto-Approvals the Rule, Not the Exception

A critical component of modern T&E solutions is the ability to recognize and auto-approve transactions tied to business and travel expenses and automatically reconcile the payment.

Only a full stack solution with context into travel, policy, employee, and payment vehicle can do this. This process takes a time-consuming and lengthy paper trail and turns it into a single button.

Integrate corporate cards with built-in policy controls

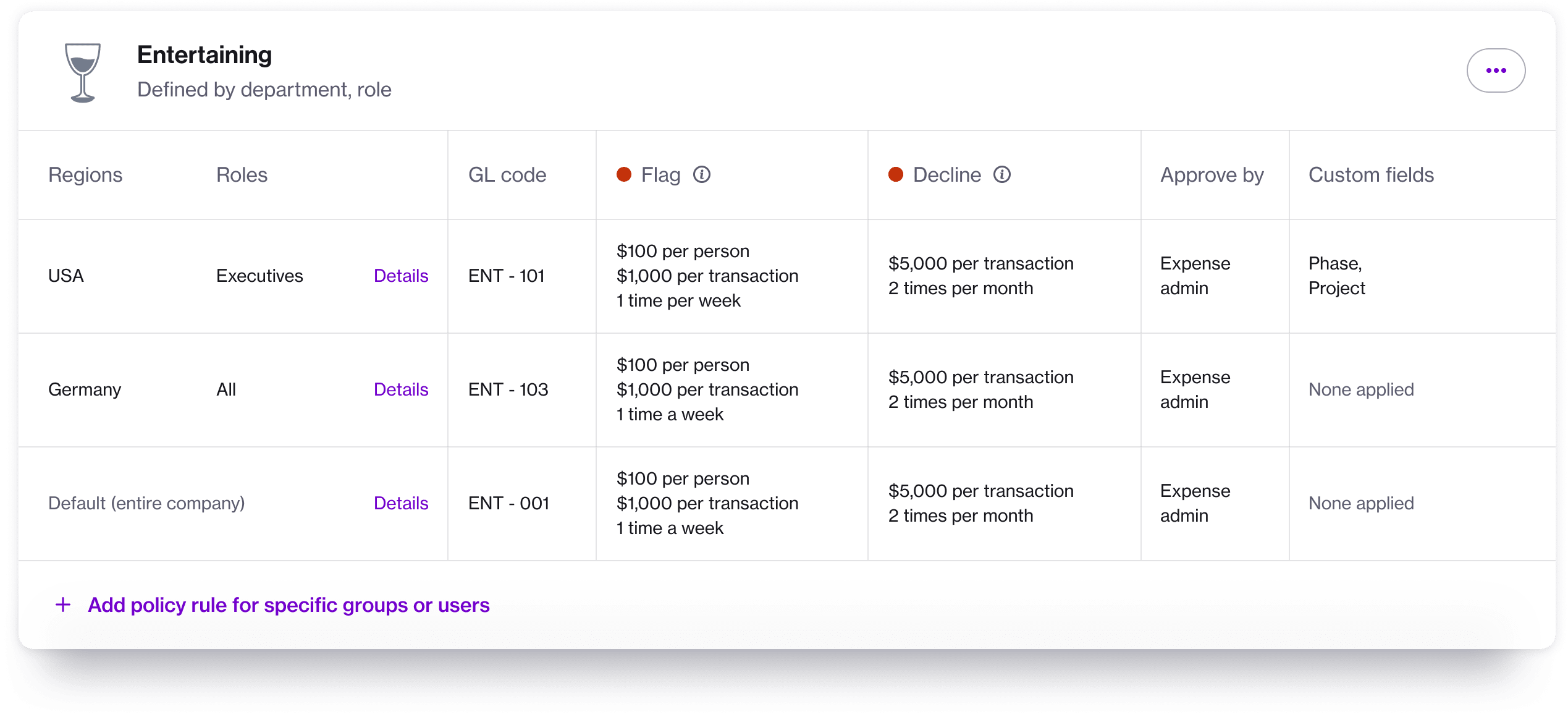

Issuing corporate cards offers a ton of benefits, but it can also make companies feel vulnerable to employee misuse. With corporate credit cards and p-cards hosting built-in policy controls, finance teams can easily create spending policies for a full range of expense categories tailored specifically to their company.

These expense policies are programmable into the corporate card so that employees can’t spend beyond the realms of the company-mandated limits.

Accelerate the month-end close with receipts and reconciliation

When reconciliation is instantaneous, finance and accounting teams immediately know how much is being spent and what it’s being spent on. This makes it more effective for finance teams to manage cash flow and allows for accurate budgeting, planning, and forecasting.

Automated reconciliation allows finance teams to mitigate financial risks. Through real-time spend visibility, finance teams can spot irregular purchasing activities and respond quickly to reduce fraud and support secure, compliant transactions.

Leveraging modern technology for modern companies

Automation provides an opportunity to save money and time, and get a jump on the competition. That’s where Navan’s travel, corporate card, and spend management solution can help. It not only streamlines a company’s process today, but grows with the business as it expands.

“Because Navan Expense automatically organizes receipts by general ledger account category, department, or cost center, we’re able to accelerate the reconciliation process of those expenses at least six times faster than the usual process of working with an expense management tool,” said Jasmine Pope, Procurement Travel & Expense Analyst at Lyft.

Click to learn how Lyft saved valuable time through efficient expense management with Navan.

Leveraging smart solutions like Navan Expense, which combine the power of virtual cards with an end-to-end spend management system, empowers finance teams to do more with greater agility.

Ready to streamline company spending and eliminate expense reports? Schedule a demo to see how our spend solutions work, or get up and running with Navan in just 5 minutes.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.