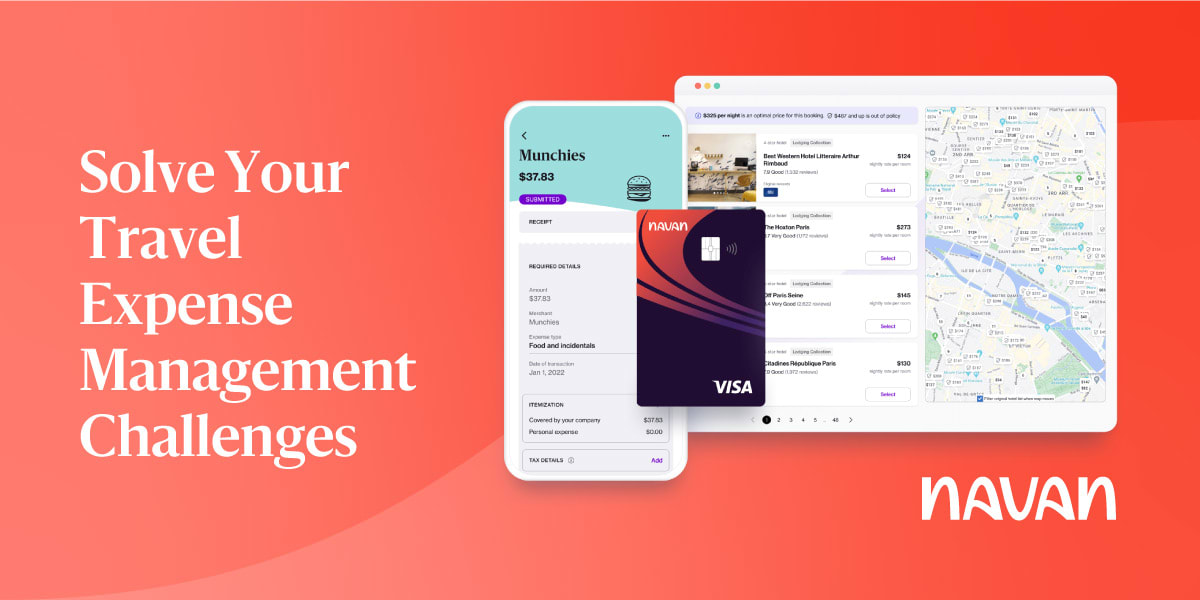

How to Solve Travel & Expense Management Challenges for Businesses of All Sizes

Travel and expense (T&E) management can be challenging for any business, regardless of industry or size. For many companies, the most common obstacles revolve around compiling, processing, and reconciling expenses.

Travel and related expenses represent a significant chunk of a company’s budget. In a recent Navan survey, tracking travel and entertainment was listed as the No. 1 largest operational headache.

Getting relief from that headache is critical, especially considering that travel is essential to growth for many industries.

When businesses manually manage travel and expenses, there’s a higher chance for human error and a potential increase in the likelihood of expense fraud, among other issues. Automating processes can solve these travel- and expense-related pain points. Specialized travel and expense software can provide that automation and enhance a business’s ability to scale and open up time for your accounting team to focus on more critical tasks.

Continue reading to understand the common travel and expense challenges businesses of all sizes face.

Challenges for Small to Medium Businesses (SMBs)

As small- and medium-sized businesses grow, travel expense management becomes increasingly complex. Companies of this size may be at the stage where they have to embrace changes and adopt technology to optimize processes, reduce costs, and alleviate frustrations.

Some of the most common travel and expense difficulties for SMBs include the following.

Inefficient Processes

Manual expense reporting is labor-intensive and prone to human error. The time it takes to reconcile the books can require many hours of manual labor from employees and managers on the accounts and finance teams.

These manual processes also open companies up to a greater potential for employee expense fraud. In a study of 600 financial leaders, 61% of respondents reported their department had witnessed employee expense abuse. Oftentimes it stems from innocent mistakes, but it can also happen when employees fabricate expenses, overcharge company cards, or find other ways to get extra payouts. It’s important to limit opportunities for fraud or misspend.

Disjointed Technology

In an effort to get a handle on their T&E program — or lack thereof — growing companies may adopt technology that doesn’t mesh well with the organization or that fails to provide the features they need to effectively manage their T&E processes.

One common error for small- and medium-sized businesses is to adopt disjointed systems as they grow. For example, a small business might use a travel management company to book and manage travel and a separate expense tracker app for employees to keep a record of expenses.

An all-in-one travel and expense solution enables companies to handle T&E programs more effectively. Employees can book travel and document expenses in a single system, and administrators have a handle on the process — from the point of sale through reconciliation. There’s one contract to manage, one system to adopt, and one data source for all company spend.

Slow Reimbursements

When employees need to use their personal credit cards to make purchases, it places an unfair burden on them. And reimbursements that take longer than necessary can affect employee satisfaction and retention rates.

When using manual processes or outdated expense technology, delays in approvals or missing receipts can cause slow repayments. Managing the process and sending reminders to employees can only streamline the process so much. Adopting virtual corporate cards can reduce the time it takes to reimburse employees and improve the employee experience.

Policy and Compliance Issues

As companies expand and business needs change, policy and compliance become more important. Policies also have to become more agile as the volume of expenses increases and the organization becomes more complex.

Effectively creating and communicating a travel policy can solve many travel and expense management challenges, such as:

- Setting specific guidelines for business travel

- Outlining covered expenses

- Providing information on approval, booking, and reimbursement processes

- Clarifying travel practices and costs for all employees

Policies should define approved travel expenses based on regulatory and compliance standards as well as your company budget.

A lack of policy is a challenge for everyone: travelers, administrators, and accounting and finance teams. But with travel and expense policies in place, employees will better understand what expenses are allowable, and accounting personnel will have the agency to enforce the rules and regulations.

Policies should be accessible and easy to understand. Unfortunately, many companies have complicated travel and expense policy rules that live in lengthy, static documents. This places a burden on both employees and administrators; employees cannot easily access the information, and administrators struggle with staying agile and communicating policy changes or updates.

Modern T&E software like Navan incorporates built-in policy controls that inform employees of policy rules as they book travel, which effectively eliminates out-of-policy spend. Administrators can tailor spend parameters based on role, expense category, business context, or other dimensions.

- 5 Ways All-in-One T&E Software Sets Small Businesses Up to Scale

- 7 Small Business Financial Challenges and How to Overcome Them

- Why Small Businesses Need Spend Control for Expenses

Challenges for Large Businesses

Large businesses and enterprises have bigger budgets and bigger challenges that often necessitate a travel and expense management solution with robust capabilities. The sheer number of traveling employees can result in siloed expense information, a lack of visibility, and greater risks.

Some of the most prevalent challenges that impact large business’ T&E management include the following.

Security Risks

Data security is a chief concern for any business. In the U.S., the average data breach costs $9.44 million. Traveling employees must divulge their sensitive data — and if they are unaware of the risks when interacting with a system, they could make your business vulnerable.

Businesses must take all the necessary steps to strengthen their expense management systems and prevent potential breaches. While travel and expense management software will simplify your management process, it must also offer robust security options such as:

- State-of-the-art encryption: Traveler data transfers require multi-layered security, and data in transit and at rest must have the highest industry standard for encryption.

- Data center security: Data centers must facilitate secure storage through innovative architectural engineering and data stored in highly secured cloud-hosted centers.

- Multi-factor authentication: Multi-factor authentication and single sign-on credentials are critical to prevent unauthorized access to your systems.

- Real-time audit logs: Keeping real-time records of data changes helps pinpoint any unusual activity on your systems, taking a preventive approach to data security.

- Third-party testing: All travel and expense management solutions should undergo rigorous vulnerability and penetration testing, security scans, assessments, and threat detection.

Lack of Reporting

Employees who submit late expense reports could impact the quality and efficiency of the travel and expense management process. Using intuitive software to remind traveling employees will help with compliance and timely reporting.

Handling multiple physical receipts is frustrating and tedious for employees and increases the burden on accounting teams to collect and verify them. Travel and expense reports should include all relevant details, accompanied by original receipts.

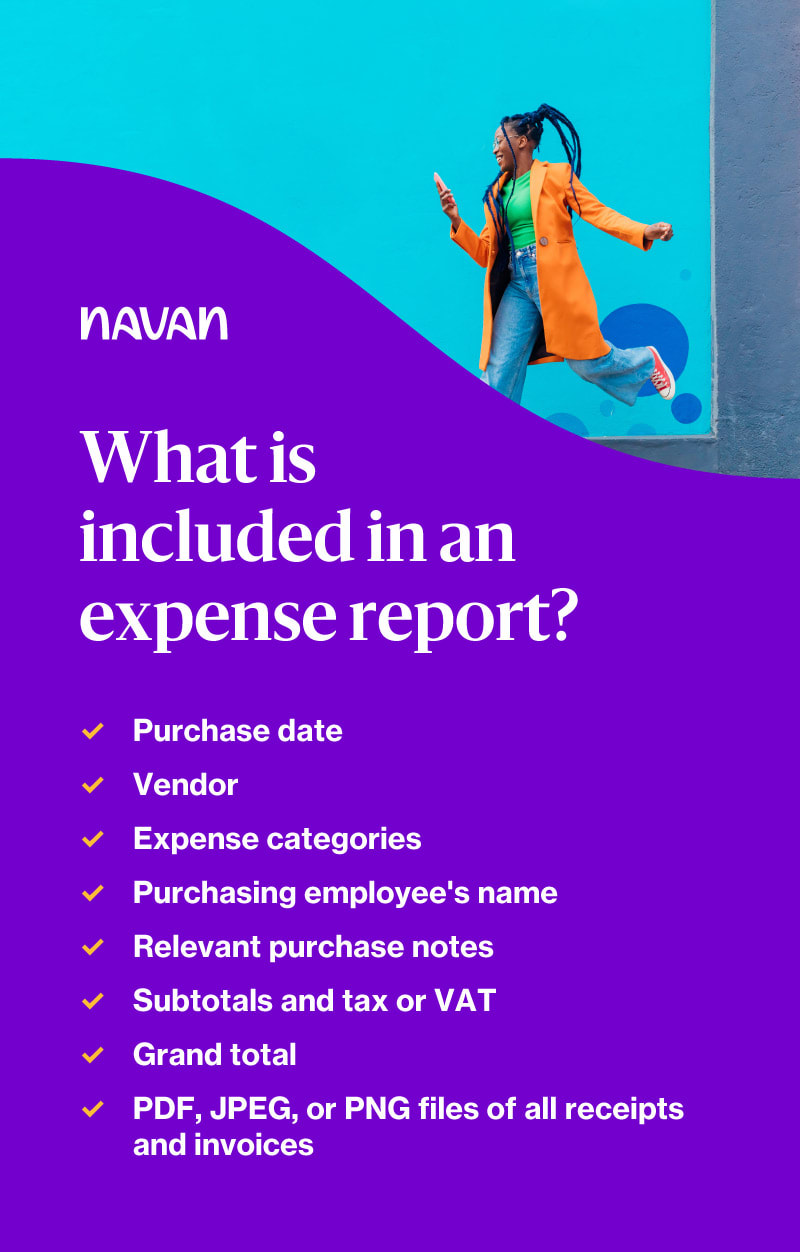

Comprehensive travel and expense reports should consist of the following:

- Purchase date

- Vendor

- Expense categories — client, department, or account

- Purchasing employee's name

- Relevant purchase notes

- Subtotals and tax or VAT

- Grand total

- PDF, JPEG, or PNG files of all receipts and invoices

That’s a lot to track, especially for on-the-go employees. Automating travel and expense reporting reduces laborious work hours, allows for real-time monitoring, and streamlines the reporting process. Providing employees with “smart” corporate cards that automatically categorize and reconcile transaction details eliminates the need for labor-intensive and error-prone expense reports.

Poor Data Visibility

Spend visibility is essential for businesses to measure whether they are operating within their planned budgets. Quality data and reporting are critical for real-time decision-making in the fast-paced business world.

Forecasting budgets is impossible without knowledge of how employees are spending money. Lack of data visibility can cause financial teams to make unnecessary errors, such as creating duplicate reports and missing receipts — challenges that become more troublesome in larger businesses.

Human Error

Many businesses still rely on spreadsheets or rudimentary expense trackers to categorize and keep track of travel expenses. Manual data entry increases the likelihood of human error, and these mistakes can affect the reporting and reimbursement processes. This has the potential to harm future budgeting and lower employee satisfaction rates.

Companies spend approximately $500,000 and 3,000 hours correcting expense reports each year, according to the Global Business Travel Association. It’s no surprise that companies are turning to expense automation to eliminate opportunities for human error and free up administrators’ time so they can engage in meaningful and productive work.

Lack of System Integration

An expense process won’t work if there is any friction with the company’s business operations. This includes stitched-together travel, expense, or accounting solutions that do not integrate seamlessly. If the systems do not mesh well, travel and expense management can become a laborious, expensive, and error-prone endeavor.

A lack of system integration in travel and expense management can result in increased costs, reduced efficiency, and increased risk for businesses. By implementing an integrated, all-in-one system, businesses can streamline their processes, improve visibility and control, and reduce the risk of fraud and non-compliance.

Complex Approval Processes

The approval management process is one of the most significant travel expense management challenges for businesses of all sizes. A manager or approver who validates expense claims is critical for accountability and transparency throughout your business.

The more convoluted the approval process, the longer it takes to reconcile expenses and reimburse employees. Typical issues that complicate the approval process include bottlenecks and approval overloads, siloed operations, and excessive approval levels. Standardizing and automating the approval process is vital to ensure compliance throughout your organization.

Expense Fraud

Larger organizations could be particularly susceptible to travel expense fraud. When tracking and verifying expenses is tedious and labor-intensive, the likelihood of administrators catching fraud attempts diminishes.

Watch for common fraud attempts like these.

- Duplicate reimbursements: Employees sharing the expense of a business trip may each claim the entire amount. These identical, duplicate claims can be challenging to identify manually.

- Padding expenses: Exaggerated expenses plague many industries, and the task of identifying erroneous claims falls to administrators who may not notice them.

- Fictitious claims: Many businesses have a policy where employees can claim up to a specific amount without receipts. Employees might make such claims without incurring the cost.

- Misrepresented expenses: Employees misrepresent personal expenses by claiming they are business-related.

Additional resources for large businesses:

- 5 Steps to Kill the Expense Report

- Creating a Travel Policy: Tips and Best Practices

- How Businesses Can Scale Travel & Expense Policy

Overcoming Travel and Expense Management Challenges for All Businesses

Regardless of your business' size, travel and expense management can take time and effort. There are many simple and practical solutions to these challenges, such as:

- Moving away from traditional or manual methods and toward digitization

- Centralizing travel data and providing additional transparency and control

- Automating travel and expense management

Companies with many traveling employees must strike a delicate balance between cost savings and employee satisfaction. Automating travel and expense management is the answer. The additional efficiency relieves frustration for all employees and allows decision-makers more autonomy over their budgeting and management procedures.

The Benefits of Automating Your Travel and Expense Management Processes

For many businesses, the most complex problems include unclear travel policies, complicated approval processes, delayed reimbursements, and time-consuming management. Travel and expense management automation can relieve these challenges and many others. Some of the many benefits include the following.

Eliminating Paperwork and Human Error

Automated expense reporting frees your travelers and administrative teams from spreadsheets and physical receipts, reducing the likelihood of errors. With automation, paperwork is unnecessary — your expense management systems allow employees to capture receipts and other relevant data via mobile devices. They can upload everything directly to the expense application and provide the finance and administration teams with a complete view.

Human bias is also a possibility when validating or approving expenses. Automation is impartial, improving your system's transparency and leveling the playing field for all employees.

Improving Policy Compliance

Modern T&E software can simplify enforcing travel expense policies across your organization. Administrative and finance personnel no longer need to verify expenses one at a time, and out-of-policy costs are flagged for review or eliminated altogether at the point of sale.

Automated expense management systems are customizable to reflect your company’s unique travel policies and routinely alert administrators to unusual expenditures. The system automatically notifies approvers of violations as they happen, which means they can address compliance challenges and approve or reject expense requests in real time.

Preventing Expense Fraud

Expense fraud is easier to commit manually, and controlling these behaviors can become complicated, especially for larger organizations. Automating expense management processes is an excellent way to mitigate the effects of expense fraud. The system immediately picks up duplicate entries and notifies the appropriate parties so they can delete or merge the expense.

With an all-in-one travel and expense management solution and corporate card program, you can set explicit travel parameters and stop deliberate expense fraud as well as accidental errors.

Streamlining Approval and Reimbursements

Inefficient workflows cause delayed reimbursements, which frustrates employees. Automating company workflows reduces the need for manual intervention, accelerates the reimbursement process, and ensures that employees will get their money back as quickly as possible.

A modern expense management solution like Navan allows administrators to build hyper-custom policies that proactively eliminate out-of-policy spend before it happens. Whether paying with cash or a personal credit card, employees can submit expenses in seconds and then be reimbursed in days. This process is lightning fast compared to traditional expense solutions, which typically use payroll to reimburse employees. It can take weeks before the money is back in employees’ pockets, which can cause unnecessary financial stress.

Increasing Spend Visibility

Keeping a close eye on company spend is imperative for long-term, measured success. But achieving a comprehensive view of spend requires a single source of truth. Cloud-based travel and expense management solutions can integrate with existing systems and centralize spend monitoring, allowing administrators to comprehensively view companywide expenses.

Using insights gleaned from high-quality, comprehensive data, finance teams can make real-time, informed decisions while monitoring cash flow. It’s easier to get a handle on the company’s financial performance, identify opportunities to improve, and better forecast where the business is headed.

Improving Employee Satisfaction and Morale

Clear policy guidelines clarify the rules and reduce confusion for employees. This practice also levels the playing field: When everyone understands and follows the same policies, employees feel they are being treated fairly, which helps foster a positive company culture.

With the peace of mind that they are adhering to the rules, some control over their decision-making, and an assurance of quick reimbursements, employees will be happier and more focused on their work.

Decreasing Processing Costs

With a single, automated system that takes care of travel and expense management, approvals, and reimbursements, companies can eliminate time-consuming and expensive manual processes. Administrators spend less time tracking expenditures and explaining rules to employees and can free up their time for more fruitful tasks.

Solve Your Travel Expense Management Challenges With Navan

Travel expense management can be complex and challenging, no matter the size of your business.

Navan provides the next generation of software designed for people. Our all-in-one, mobile-first travel, corporate card, and expense management solution is here to solve every travel expense management challenge you might encounter. Navan's software allows you to book and manage business travel and expenses from one centralized hub, providing complete transparency from swipe to reconciliation.

Ready to streamline company spending and implement an all-in-one travel and expense management solution? Schedule a demo to see how our spend solutions work, or get up and running with Navan in just 5 minutes.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.