How Small Businesses Can Automate Expense Tracking

Gone are the days of pen and paper ledgers, rudimentary spreadsheets, and software that fails to integrate with your bank and business processes. In the same way that you can now order a car ride in a few taps or deposit checks with your phone’s camera, technology has simplified business expense tracking.

If you’re a small business owner or entrepreneur wondering how you can better track day-to-day expenses, the step-by-step guide below will make the expense process a breeze while saving time and money.

And yes, the entire expense process can be completed in a mobile app.

Why should I track expenses?

Before digging into the how, it’s essential to understand the why. If you have a business, you have business expenses. Tracking these expenses helps small businesses:

- Create a budget

- Manage receipts properly

- Record all expenses promptly

- Keep documentation in the event of an IRS audit

- Take advantage of tax deductions

- Manage and optimize cash flow

- Spot outliers and identify cost savings

Small business expenses vary widely but typically fall into categories such as travel expenses, advertising and marketing expenses, and rent or mortgage payments.

How can technology help with expense tracking?

Many small business owners and entrepreneurs are waking up to the fact that they can—and need to—upgrade how they control, manage, and track expenses. Technology can solve many expense-related pain points that small businesses see. These solutions can:

- Streamline and automate expense tasks

- Eliminate unchecked spending

- Do away with data entry errors

- Organize financial records for tax season

- Give back hours spent chasing receipts

- Enable companies to see financial data in real time

Adopting accounting software will simplify every aspect of the expense process and minimize the financial risks associated with traditional expense management.

Step by Step: How Small Businesses Can Automate Expense Tracking

1. Start a dedicated business credit card

Small businesses often blur the line between professional and personal expenses. Opening a dedicated business credit card helps clearly define business-related expenses and is the logical first step in establishing an accounting system for your small business.

If you already have a separate bank account for your business income, you may wonder if a credit card is necessary. Unlike business bank accounts, credit cards have some surprising benefits, including helping your small business do the following:

- Build a better credit score: Your business has a credit score, and keeping that score healthy is crucial if you plan to secure a small business loan or financing. The quickest way to build a credit history for a small business is to have a dedicated business credit card.

- Enable employees to make authorized purchases: As your company grows, more employees will need to make business purchases, including office supplies, software subscriptions, or travel expenses. If loosening the purse strings sounds scary, fear not: Modern business credit cards enable administrators to set spend controls, which eliminates any rogue spending.

- Stay protected in the event of fraud: If a criminal accesses your business debit card, money comes directly out of your bank account and is gone. On the other hand, credit card companies are more likely to act to get issues straightened out. Additionally, fraudulent transactions won’t affect the businesses’ available cash.

- Collect credit card rewards: It pays to put your business expenses on a credit card that allows your small business to earn rewards, perks, or bonuses. These rewards include points for travel or a percentage of cash back. For example, in the past year alone, Premier Talent Partners has received more than $10,000 back from the Navan corporate card rebate.

Not all credit cards are created equal. Small business credit cards and corporate cards are two popular choices, and it’s worth researching the differences between each type of credit card to decide which avenue fits your small business’s long-term needs and goals.

2. Avoid using cash at all costs

Now that your small business has a dedicated credit card, all employees need to use it for every transaction. Using cash hurts small businesses because:

- Cash is tricky and time-consuming to monitor. Using cash makes bookkeeping difficult, because businesses need to keep receipts—and often, retroactively track them down—before manually inputting information into accounting software.

- Cash is risky. Come tax time, businesses that use cash are more likely to be audited by the Internal Revenue Service (IRS). Your small business could be at risk if you need to provide detailed financial statements for an audit.

Alternatively, when everyone in your company uses digital transactions:

- A record is in the bank statement

- All expenses go through the same process and use the same language

- It’s easy to get insights into exactly where money is going

- The business is prepared in the event of an IRS audit

Startups and small businesses often fall victim to using cash to avoid fees or accruing interest, which companies can easily avoid by selecting a credit card carefully and then using it responsibly.

3. Invest in accounting software

Now that your small business has its finances sorted, it’s time to find the right accounting software. The good news is that technology tools for managing finances that were once only available to big businesses are now accessible and affordable for small businesses, too.

Although there are many rudimentary accounting apps to choose from, it’s wise to look for software that can control, manage, and track expenses. This type of technology is known as expense management software.

Minimum Requirements

When searching for expense management software, it should—at a minimum—have the following functionalities:

- An integration with your business credit card

- Technology that scans and digitizes paper receipts/invoices

- Capability to automatically itemizes invoices/receipts and categorize expenses

- Tools that give administrators real-time data insights

Warning: Some basic business expense tracker apps only scan paper receipts and do not capture transaction details by line item (a process known as auto-itemization). Without this breakdown of expenses within an invoice/receipt, your company won’t have the details needed for business taxes and accounting purposes.

Setting Your Small Business Up to Scale

As companies scale, the technology that powers how they track business expenses should scale, too. If you have employees—or plan to have them in the future—look for an expense management solution that:

- Allows you to build in policy controls: An administrator should be able to control policies based on role, expense category, business context, and more, allowing your business to prevent policy violations at the point of sale.

- Can distribute cards at scale: Ideally, the solution should equip your business with the ability to issue an unlimited number of physical and virtual cards.

- Is available as a mobile app: If the software is only accessible on a desktop computer, it’s less likely that employees across the business will use it. On the other hand, employees will be empowered to use an expense tracking app if it is always at their fingertips.

- Is user-friendly: Investing in expense management software means little if employees don’t bother to use it in the first place. The experience should be consumer-friendly and intuitive.

4. Dig into the data

Congratulations! If your small business has followed steps 1-3, you’ve successfully created a single source of truth for all business spend. Now that you keep up-to-the-minute financial records, it’s time to take a deep dive into the data.

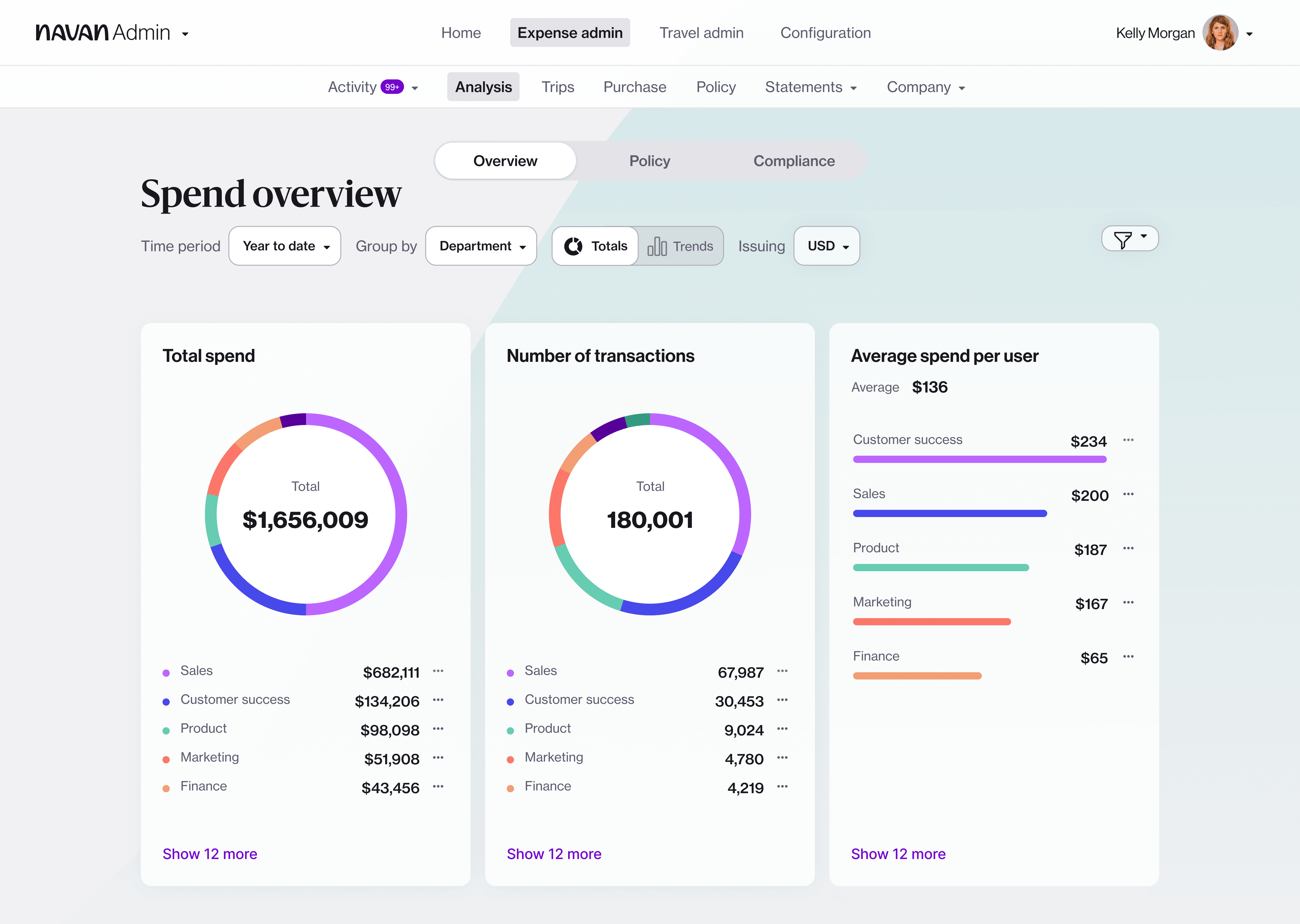

What story are the numbers telling you? You should be able to slice and dice the data to:

- Understand current business finances

- See how your monthly or annual spend is trending

- Spot outliers and identify cost savings

- Make financial predictions

- Gain insights into policy compliance

Some expense management software also allows you to see how your small business compares to other companies in your industry of a similar size.

With data and dashboards at your fingertips, you can make financial and policy decisions that best serve your company. Not only is your business saving time and money, it’s also gaining insights that would be impossible to glean from a traditional pen-and-paper ledger or a makeshift spreadsheet.

The Simplest Way to Track Business Expenses

Interested in a solution that does all of the above? Navan Expense is a corporate credit card with a built-in expense tracking app that automates every step of the expense process. It gives companies one easy place to control, manage, and track spending—from payment to reconciliation.

A few benefits for small businesses include:

- Granular policy controls: Spend controls are built into Navancards and are auto-enforced at the point of sale, allowing small businesses to distribute physical and virtual cards with confidence.

- Rapid reimbursements: By connecting the Navan Expense mobile app with personal bank accounts, employees can receive rapid reimbursements in one business day.

- No expense reports: Purchase notifications go straight to the administrator, eliminating the need for dreaded manual expense reports. On average, companies that use Navan close the books 4 days faster each month.

- Real-time visibility: Get a picture of spend, slice and dice data, and forecast finances.

- Unlimited cash back: Receive a competitive cash rebate on all spend paid with Navan Expense virtual and physical cards. See our pricing for details.

Don’t just take our word for it. Hear from a few small business owners on why they think Navan is the best expense solution for their companies:

“[Navan is] so easy to use. In my line of work, time is my most valuable resource; by eliminating the monthly expense report process, I gain hours back each month.”

“For us, as a smaller business, Navan is absolutely worth the investment. I can’t imagine going back to what we did before.”

“It’s just so easy. It’s so much better than anything else we’ve ever looked into. I love that everything is in one place for accounting. The customer service is fantastic. It’s been a great experience.”

Ready to start using Navan today? Get up and running in 5 minutes.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.