Implementing Effective Corporate Credit Card Practices for Financial Integrity

The Navan Team

Corporate credit cards are indispensable tools in modern business, streamlining payment processes and promoting efficient management of company expenses. However, the convenience they offer can also pose significant risks if not managed with strict controls and adherence to best practices. The essence of maintaining financial integrity lies in implementing rules and fostering a culture where every transaction is made with accountability.

Understanding Corporate Card Management

Corporate credit card management is a critical aspect of business administration, focusing on maximizing benefits while minimizing financial risks. Effective management covers everything from setting up the right controls to tracking expenditures and making sure that all transactions comply with company policies. By emphasizing the importance of this management, companies can prevent fraudulent activities and maintain accurate financial records, which are crucial for any successful business.

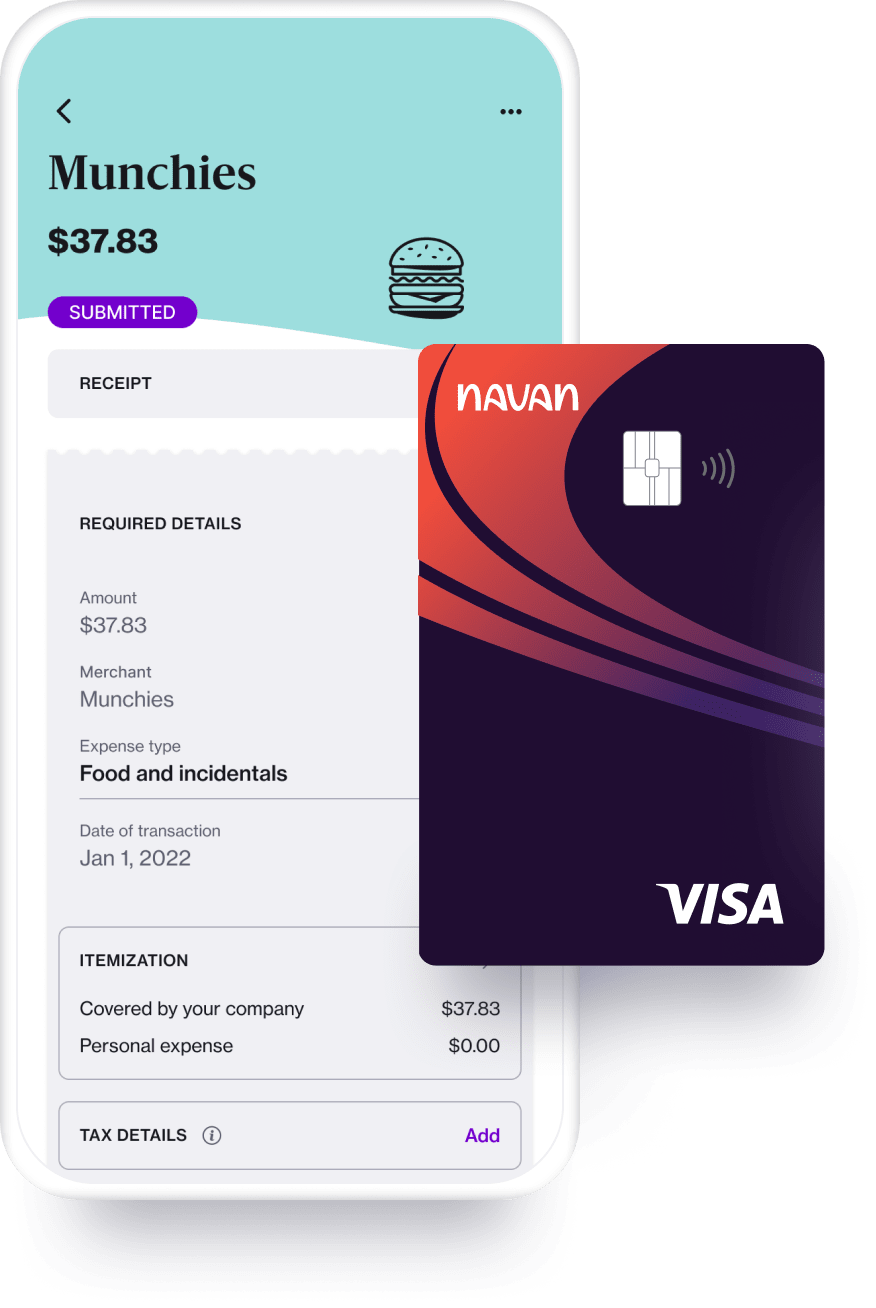

Navan Corporate Cards: Effortless Expense Tracking with Every Payment

Managing corporate expenses has never been easier. Navan corporate cards automatically log, categorize, and verify transactions against company policies — eliminating manual effort while keeping budgets in check.

Why Choose Navan Corporate Cards?

►

►

►

►

►

Navan corporate cards transform company spending into a seamless, automated experience — giving businesses greater control and transparency.

Key Techniques

Managing corporate credit cards requires a structured approach to maintain financial control and prevent misuse. The following techniques help streamline expense tracking, improve compliance, and promote responsible spending within an organization.

Establishing Clear Corporate Card Policies

A clear set of policies is the foundation of effective corporate credit card management. Such policies define acceptable use, set spend limits, and outline the methodologies for reporting expenses. These guidelines are crucial as they provide employees with a clear framework for operating, which makes expectations clear and defines which actions are acceptable.

Defining Employee Eligibility Criteria

Another essential step is determining who is eligible to hold a corporate credit card. Not every employee needs access to a corporate card; eligibility should be based on specific factors such as the role within the company, spending needs, and travel frequency. This approach prevents misuse by limiting access to those needing a card for their professional duties.

Implementing Spend Limits and Controls

Setting spend limits and controls is essential to prevent unauthorized transactions. These limits should be carefully considered to strike the right balance between necessary spending flexibility and tight control to avoid misuse.

By adopting an expense management platform like Navan, companies can set spend limits and automated approval workflows that align with company card policy, thus streamlining the expense management process.

Enforcing Timely Expense Reporting

Timely and accurate expense reporting is vital to maintaining up-to-date financial records. Employees should be encouraged, if not required, to submit all supporting documents, like receipts, immediately after incurring an expense. This practice helps in quick expense reconciliation and prevents unreported expenditures from piling up.

Conducting Regular Audits and Monitoring

Regular audits and continuous monitoring are essential for the early detection of discrepancies or policy violations. These practices not only help identify issues promptly but also act as a deterrent against potential misuse, as employees know their spending patterns are being tracked and monitored.

Providing Comprehensive Employee Training

Training helps employees understand credit card policies and makes it easier for them to follow the guidelines. Effective training programs should cover the ethical use of corporate credit cards, the importance of compliance with financial policies, and the consequences of misuse.

Utilizing Expense Management Software

Modern businesses benefit greatly from technology, particularly expense management software like Navan, which can automate and streamline the tracking of credit card expenses. These systems provide real-time insights into spending, helping companies monitor their financial outflows and simplifying the management of receipts and expense reports.

Defining Consequences for Policy Violations

It is crucial that the consequences for violating credit card policies are clearly defined and communicated to all employees. Whether these are minor infractions that result in warnings or major misuses that lead to job termination, having clear consequences helps enforce the rules and maintains financial discipline.

Benefits of Adopting Best Practices

Adopting best practices of corporate card management can significantly reduce financial risks and improve the accuracy of budget forecasts. Moreover, they promote a transparent and accountable work environment crucial for internal audits and financial management. The peace of mind that comes from knowing that finances are properly managed is invaluable for any finance and accounting teams.

Above: A traveler using the Navan app and corporate card

Implementing Best Practices in Your Organization

To effectively implement these best practices, start by developing detailed policies and procedures that are communicated clearly to all staff. Continuous training and robust monitoring systems can reinforce these policies, promoting ongoing compliance and financial integrity.

Simplify Policy Enforcement With Navan

With Navan’s integrated policy settings, companies can trust that policy enforcement is automated and transparent for all employees. The platform’s built-in policies help reduce violations caused by unclear guidelines and miscommunication. This streamlined approach simplifies the expensing process while saving companies time and money.

Read more to learn about Navan’s expense management solution.

Exploring the Role of Technology in Enhancing Compliance

The role of technology in managing corporate credit cards cannot be overstated. Expense management software, for instance, not only automates the approval process and tracks spending in real time but also reduces the likelihood of errors and fraud. These technological solutions are transforming how companies handle their financial operations, making them more efficient and compliant.

Corporate Credit Card Best Practices

Meet Navan

Navan provides a comprehensive travel and expense management solution that significantly simplifies corporate credit card management. The platform offers real-time tracking, customizable spend controls, and smooth integration with existing financial systems, making expense management more efficient and hassle-free.

Above: A submitted expense report on Navan’s app using a Navan corporate card

Summary

Implementing effective corporate credit card practices is crucial for any organization aiming to safeguard its financial resources and promote a culture of accountability. With careful planning, clear communication, and the right technological tools, businesses can achieve financial integrity and control, which promotes the smart use of corporate credit cards within company guidelines.

Ready to implement the best practices of corporate card management? Start using Navan for free and get set up in just 5 minutes.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.