What Is an Itemized Receipt?

An itemized receipt is a detailed record that breaks down the components of a purchase, providing specific information about each item or service acquired.

Itemized receipts are essential documents in the travel and expense management industries, as they offer transparency and accountability. This comprehensive guide explores the various aspects of itemized receipts, their significance, and how to manage them effectively in these fields.

What is an Itemized Receipt?

An itemized receipt is a document provided by a seller to a buyer, listing all individual items or services purchased. Unlike a simple receipt, which may only show the total amount spent, an itemized receipt includes:

- Item Descriptions: Detailed names of the products or services.

- Quantities: The number of each item purchased.

- Prices: The cost of each item.

- Subtotal: The combined cost of all items before taxes and additional charges.

- Taxes and Fees: Any applicable taxes and other fees.

- Total Amount: The final amount paid by the buyer.

Typical vs. Itemized Receipts

When an employee books a $553 hotel stay for a business trip, it’s recorded under “Lodging” in accounting; however, individual expenses within that total must be separately tracked for accounting clarity.

- Total Amount: $553 - “Lodging”

- Room charge: $420 - “Lodging”

- Resort fee: $30 - “Lodging”

- Room service: $63 - “Meals for myself”

- Daily parking: $40 - “Parking”

- Total Amount: $553

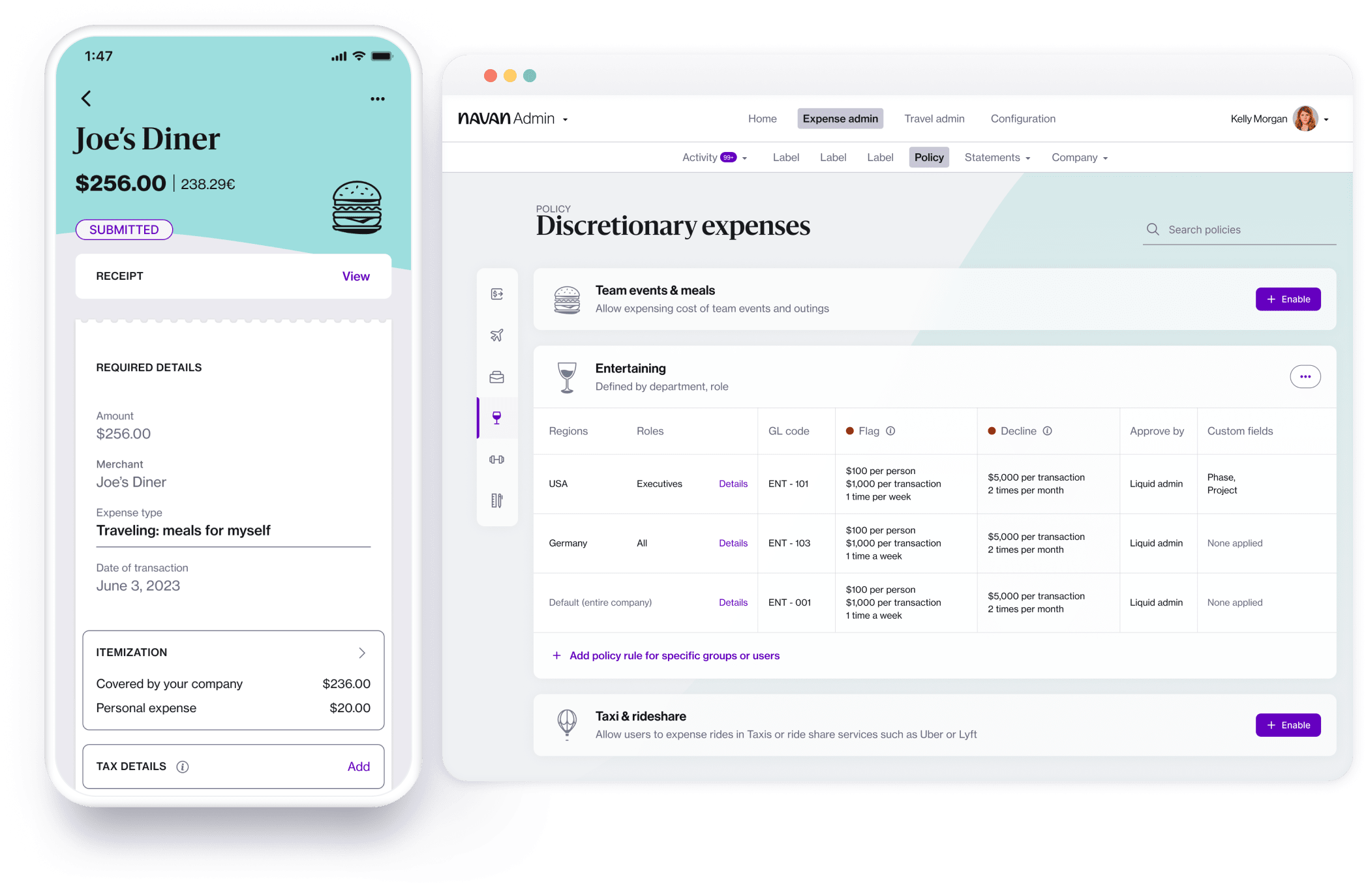

See how Navan auto-itemizes receipts to ensure all company expenses are correctly accounted for.

Importance of Itemized Receipts in Travel and Expense Management

Itemized receipts play a crucial role in travel and expense management.

For Travel Managers

- Expense Tracking: Helps in tracking travel expenses and managing travel budgets.

- Policy Compliance: Ensures adherence to company travel policies.

- Vendor Management: Provides insights into vendor performance and spending patterns.

For Finance Leaders

- Accurate Reimbursements: Essential for accurate reimbursement processing.

- Tax Deductions: Important for claiming tax deductions and credits.

- Financial Audits: Provides a clear audit trail for financial reviews.

For Accountants

- Expense Reporting: Facilitates accurate and detailed expense reports.

- Fraud Prevention: Helps in identifying and preventing fraudulent expense claims.

- Compliance: Ensures compliance with financial regulations and company policies.

Key Elements of an Itemized Receipt

An itemized receipt typically includes the following elements:

- Vendor Information: Name, address, and contact details of the seller.

- Transaction Date: Date when the purchase was made.

- Payment Method: Information about how the payment was made (e.g., cash, credit card).

- Item Details: Descriptions, quantities, and prices of each item.

- Subtotal: Sum of all item costs before additional charges.

- Taxes and Fees: Breakdown of applicable taxes and fees.

- Total Amount: The final amount paid by the customer.

- Additional Notes: Any additional information or terms related to the purchase.

Managing Itemized Receipts in Travel and Expense Management

Proper management of itemized receipts is essential in the travel and expense management industries. Here are some tips for effective receipt management:

For Travel Managers

- Organize Receipts: Ensure travelers organize receipts during their trips.

- Use Travel Management Tools: Utilize tools that automate receipt collection and expense tracking.

- Policy Training: Train employees on company policies regarding itemized receipts.

For Finance Teams

- Establish Clear Policies: Create clear policies for receipt submission and reimbursement.

- Implement Software: Use expense management software to automate receipt tracking and reporting.

- Regular Audits: Conduct regular audits to ensure compliance and accuracy in expense reporting.

For Business Travelers

- Keep Receipts Safe: Store receipts in a safe place to avoid damage or loss.

- Use Apps: Utilize receipt management apps to digitize and categorize receipts.

- Review Receipts: Regularly review receipts to ensure completeness and accuracy.

Common Challenges and Solutions

While itemized receipts are valuable, they can also present some challenges:

Lost or Faded Receipts

Incomplete Receipts

Receipt Management

Above: Screenshot of an expense submission on the Navan platform next to the administrator view of policy controls.

Best Practices for Travel and Expense Management

Implementing best practices for handling itemized receipts can enhance the efficiency and accuracy of travel and expense management:

Digital Solutions

- Mobile Apps: Use mobile apps for scanning and storing receipts immediately after a purchase.

- Expense Management Software: Integrate with software that automates the collection, categorization, and reporting of receipts.

Clear Policies and Training

- Policy Documentation: Clearly document company policies on expense reporting and receipt submission.

- Employee Training: Regularly train employees on the importance of itemized receipts and how to manage them effectively.

Regular Reviews and Audits

- Expense Reviews: Regularly review submitted expenses to ensure accuracy and compliance.

- Internal Audits: Conduct internal audits to identify and address any discrepancies or issues.

Itemized receipts are vital tools for financial management and accountability in the travel and expense management industries.

By understanding their importance and implementing effective management practices, travel managers, finance leaders, and accountants can ensure accurate expense tracking, compliance, and financial transparency.

Adopting digital solutions and maintaining clear policies will further streamline the process, enhancing the overall efficiency of travel and expense management.

Frequently Asked Questions

Read now

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.