Business Travel and Spend Trends: 2023 Year in Review

- Global travel bookings continue to climb, up nearly 50% YoY

- Forward bookings for 2024 are up 60% YoY

- Airfare has settled into 2019 booking prices

- Europe continues to rebound, with bookings up 2x YoY

- Rail continues to increase in share of EU transportation bookings

- Blended or bleisure travel bookings accelerated, with a 76% jump YoY

- Starbucks remains fast-food king for road warriors

Introduction

We’ve heard it all year: Business travel is finally back. But what does “back” actually mean? Despite the pandemic-era predictions that business travel would never recover, analysts now expect the global market to fully recover (and surpass) pre-pandemic volumes in booking and spend within the next two years.

It’s a rebound that the Navan team has been predicting since 2020, when we recognized that a more distributed workforce and more diverse work models would lead to more travel, not less — even though that travel might look a bit different. In true form, Navan immediately launched solutions to support this new normal. Features included the ability to extend a business trip with personal days to support the uptick in blended or bleisure travel; a team travel booking platform to help bring groups together; global reimbursements in local currency; and an upgraded loyalty program that rewards employees with personal travel to meet the increase in leisure demand.

Now, after years of disruptions and high interest rates, airfare is finally normalizing, blended travel is continuing to climb, and business spend is evolving. Pre-pandemic sentiment around the importance of in-person meetings has returned as well. The 2024 Skift report found that the percentage of travel and finance managers who agree that meeting in person is more effective than meeting virtually has fully returned to 2019 levels — and almost fully returned for travelers.

To get a sense of how behavior has shifted over the past year, we dug into Navan’s travel and spend data over the course of 2023 and compared that to 2022. Here’s a snapshot of the trends we’ve seen — and what they might mean for the year ahead.

Let’s dive in!

Travel

Business Travel Bookings

The pandemic may feel light years in the past, but 2023 was actually the first full year of uninterrupted post-pandemic travel. And some familiar patterns emerged. January travel bookings started slow but then skyrocketed and maintained a high volume until travelers took a break for summer vacations. Fall conference season brought road warriors back to the road until the arrival of the traditional holiday lag. But here’s the bottom line: Business travel has indeed returned. In 2023, Navan recorded a 46% increase in global travel bookings year-over-year (Jan. 1 – Nov. 31). And it doesn’t seem like demand is going anywhere — forward bookings with a trip start date in 2024 are up 60% compared to bookings made for 2023 this time last year.

Average U.S. Domestic Flight Booking Price

No question: The tumultuous macroeconomic environment of 2022 pushed air travel prices up to higher-than-usual levels. But this year, domestic flight booking prices in the U.S. have come back down to earth and are now at 2019 levels. The average U.S. domestic booking price is down 21% from its peak in 2022, settling at $419 in November 2023 — just $4 more than the Nov. 2019 average booking price.

Average Daily Travelers per Company by Segment

Which types of companies are hitting the road? Traveling SMB employees have maintained a remarkable consistency throughout the pandemic and post-pandemic eras. Mid-market and enterprise companies, on the other hand, have followed a more predictable pattern, experiencing a slowdown in 2020, followed by an explosion of activity in 2022 and an additional increase in 2023.

Top Blended Travel Trends and Destinations

With a personal travel platform and an incentive program that rewards users with leisure travel credit for booking under policy, Navan makes it easy for business travelers to extend their business travel with personal days — and more of them are taking advantage. In the 2024 Skift report, 68% of business travelers said they plan to add a personal vacation to a business trip. Managers are on board as well, with 58% responding that they actively encourage their employees to do just that.

Hard data bears the survey responses out. Navan has recorded a

Where are Navan’s travelers heading to work and play? It won’t come as a surprise that the world’s most iconic cities form the backdrop for blended travel. New York, San Francisco, and London sit atop the list, with global representation from the likes of Sydney, Dublin, Singapore, and Barcelona. Bachelorette-friendly Nashville, TN (aka “Bachville”), comes in at No. 25.

Who’s Traveling Now?

Booking Share by Industry

After some predictable pandemic dips for some types of businesses, the relative portion for each remained remarkably stable throughout 2023. The software and Internet category continues to consume the biggest bandwidth, followed by business services and retail.

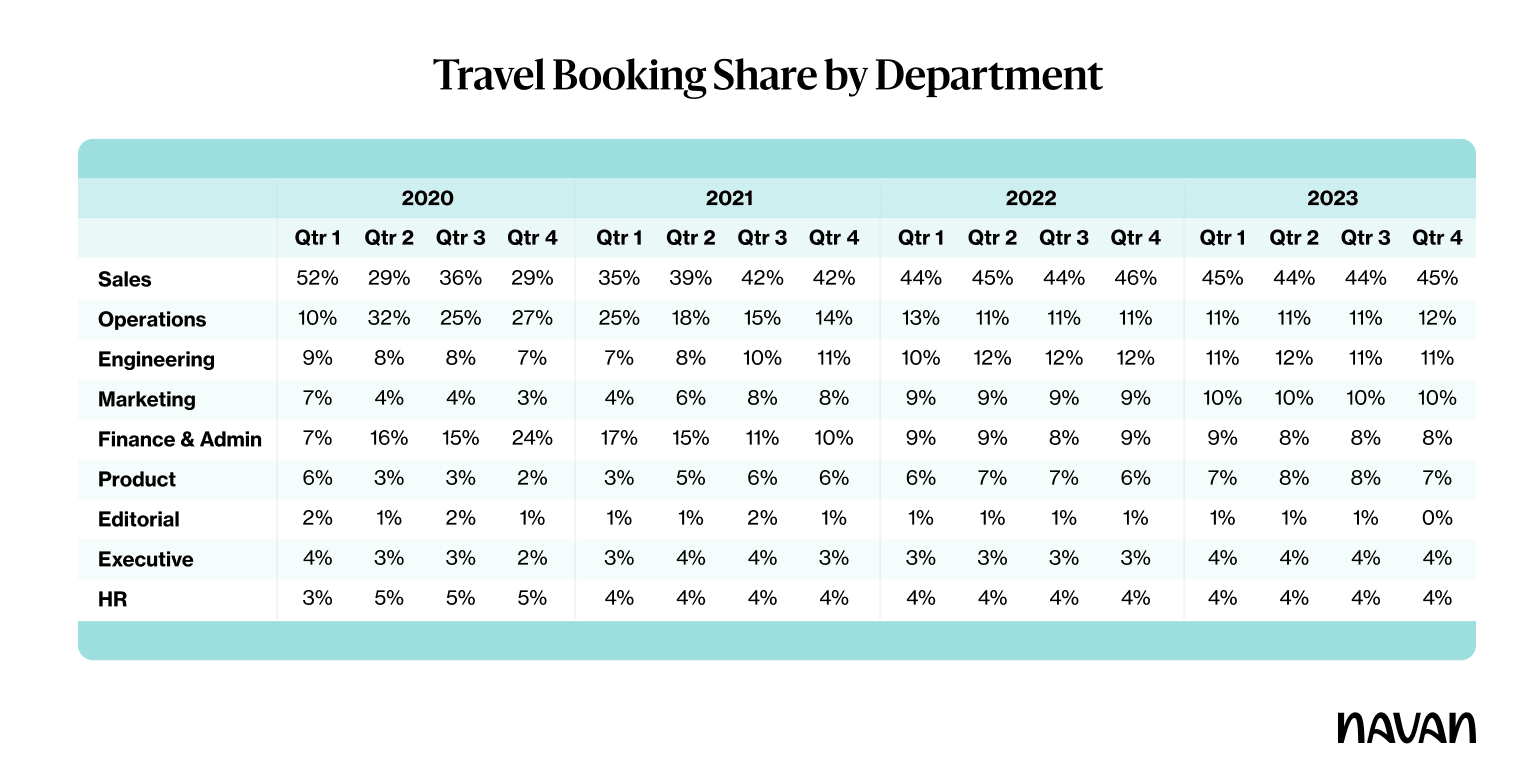

Booking Share by Department

Similar to travel booking share by industry, travelers from certain departments have maintained a relatively steady level after pandemic-related changes. Sales teams continue to claim the plurality of travelers, dropping from 54% of travelers pre-pandemic to a low of 29% in Q2 2020, and settling in at the mid-40% range since 2022.

Meanwhile, engineers, who made up 7% of travelers pre-pandemic, now represent 11% (a jump of 4 percentage points); marketers, who also represented 7% of travelers pre-pandemic, have increased 3 percentage points and now represent 10% of travelers. And operations teams, required to be on-site during the pandemic tumult and comprising 32% of travelers at the peak of the pandemic, now make up a smaller — though still significant — share of travelers at 12% (2 percentage points higher than pre-pandemic).

Team Travel Booking Volume

It’s no surprise to see some variation in this chart. After all, businesses keep reassessing the way they handle remote work and adjusting the level of travel they need to maintain strong team bonds. While team travel booked on Navan leveled off this fall, the volume of group travel in October 2023 still represents a whopping 51% increase over October 2022.

Business Travel Bookings by Trip Duration

Trips of two to three days continued their steady climb in 2023. And quick, one-day trips were up from their 2022 level. Trips of four to seven days dipped slightly, but were still happening at a higher volume than in 2019.

Daily Bookings per Company by Industry

Which industries are traveling the most? Retail has seen the biggest bump over last year, with a 36% increase in travel bookings. Media and financial services employees have hit the road in increasing numbers as well. A couple industries slowed the pace of their travel a bit, including manufacturing, consumer services, and business services.

Spend

Spend Volume Growth by Month

Where there’s travel, there will be expenses. And as in-person interactions have returned, spending has surged. Spend volume processed via Navan Expense saw a nearly 2x YoY growth (Jan. – Nov. 2023, as compared to Jan. – Nov. 2022). Even the predictable summer slowdown saw distinctly higher levels of spend compared with last year.

On-Trip Spend Volume

As in 2022, airfare claimed the plurality of travel spend in 2023 — 11% — which was down from 2022, when airfare’s share of spend reached nearly 12%. On the other hand, some categories saw an increase in the share of travel spend, such as restaurants, rideshares, and hotels, which grew by 3.7%, 8.5%, and 11.2%, respectively.

Businesses also expanded their use of passenger railways, which increased from just 1% of all business spend in 2022 to more than 1.4% in 2023. This change could indicate an increased focus on cost savings or on more sustainable travel.

Off-Trip Spend Volume

The desire for in-person gatherings — both among team members and with sales teams — remains high. According to Bizzabo, almost 78% of interviewees strongly agree that in-person conferences and meetings offer the best networking opportunities. Employees also agree: In 2023, almost 5% of businesses’ spend volume went to restaurants — a level more than 2% higher than any other category besides rideshares and miscellaneous.

Top Fast-Food Restaurants

Whether they’re on the road or staying local, employees continue to want their service to be fast and their restaurants to be familiar. Starbucks once again crushed the competition this year, despite a decrease in its spend volume share from 2022. Meanwhile, Dunkin’ and Chick-fil-A saw increases in popularity this year.

How Employees Spend by Department

It’s no surprise that sales teams spend more than other departments, both on- and off-trip. And this year, marketing and operations came in second and third, respectively. Interestingly, it was accounting teams that recorded the biggest cut in their share of company spend volume in 2023, decreasing their share from nearly 2% in 2022 to less than 0.5%.

In-Person Employee Spend: Team Events & Drinking Places

Drinking Places

Companies have long recognized the benefits that come from gathering together. So, even as companies across all segments cut their overall costs this year, not all of those segments extended their reductions to drinking venues. When comparing the median transaction from 2022 to 2023, commercial and enterprise businesses reduced their respective spend on drinking places by around 5%. Meanwhile, mid-market companies increased the median drinking place spend, though by just 1.3%.

Team Events & Meals

While team travel volume grew in 2023, businesses overall paid a smidge less for team events/ meals. Mid-market companies reduced median spend from $53 in 2022 to $49 this year — an 8.2% decrease year-over-year. Small businesses and enterprise companies also paid a bit less for team events — more than 6% year-over-year. Of all segments, commercial businesses saw the smallest decrease in median spend, with a change of only 5.1% — from $51.38 in 2022 to $48.74 in 2023.

Average Conference Transaction Amount

With conferences becoming more experiential and increasing in importance as a hub to meet with colleagues, clients, prospects — and yes, friends — it’s no surprise that conference transaction volume increased 216% YoY on Navan Expense. The average transaction amount, however, decreased by 22% on average, which could indicate declining prices or the implementation of stricter policies around conference spend — without a limitation on attendance.

Europe

EU-Origin Bookings

Europe saw travel bookings increase nearly 2x (94%) year-over-year (Jan. 1–Dec. 31 as compared to Jan. 1–Dec. 31, 2022).

Average Intra-EU Booking Price

Prices for flights inside the EU follow a similar pattern to those in the U.S. a dip during the pandemic, a high in early 2022, then settling down a bit in 2023.

Plane, Train, or Automobile?

France’s ban on short-haul flights took effect in May, prohibiting domestic air travel on routes that would take less than 2.5 hours by train. Will it be effective in reducing carbon emissions? Initial reactions were mixed.

But perhaps even the increase in awareness around sustainability is having an effect. According to Navan data, the share of rail bookings with an EU origin increased 4 percentage points YoY as compared to other forms of transportation. Meanwhile, air travel decreased by 5 percentage points; car rentals were up by 1 percentage point.

But perhaps even the increase in awareness around sustainability is having an effect. According to Navan data, the share of rail bookings with an EU origin increased 4 percentage points YoY as compared to other forms of transportation. Meanwhile, air travel decreased by 5 percentage points; car rentals were up by 1 percentage point.

Conclusion

In some ways, we’ve finally come full circle from 2019: After all, travel is back up and airfare is back down in both the U.S. and Europe. Other areas within travel and expense, though, have undergone a transformative change, like the huge surges in team travel and blended travel.

Still, the wild gyrations of the pandemic appear to be over, and some of the resulting trends seem to be settling into steady new patterns.

But don’t get too comfortable: Generative AI is barreling down the tracks — and this transformative technology has the potential to upend everything, as companies of all types are chasing the next big thing.

Exactly when developments in generative AI will begin to impact most travel and spend patterns remains to be seen. But amid the inevitable tumult, it seems a safe bet that Starbucks will remain the ringleader of fast-food restaurants — at least, until GenAI learns how to deliver deskside lattes.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.