Create Your Corporate Expense Policy with Navan’s Free Template

Having a clear and well-defined expense policy is crucial for any organization. An effective expense policy helps companies control business expenses; it also fosters transparency, accountability, and compliance among employees.

In this blog post, we’ll discuss the key components of an expense policy, why it’s important, and how you can use our free downloadable expense policy template to start creating one for your company.

What is an Expense Policy?

An expense policy is a set of guidelines outlining what expenses are reimbursable, the process for submitting expenses, and the documentation required to support those expenses.

This type of policy is essential for defining acceptable business-related expenses and communicating to employees the expectations regarding spending.

5 Reasons Expense Policies Are Important

1. Gain Control Over Company Spend

An expense policy helps businesses monitor and control spending. By setting clear guidelines, companies can reduce unnecessary expenses and validate that funds are allocated appropriately.

2. Provide Clarity for Employees

A well-defined policy removes ambiguity for employees regarding what expenses can be claimed. This clarity helps prevent misunderstandings and potential disputes between employees and management.

3. Streamline the Reimbursement Process

When employees know how to submit expenses, the reimbursement process is simplified and accelerated. This efficiency can lead to higher employee satisfaction and better morale.

4. Enhance Compliance

An expense policy promotes compliance with tax laws and regulations by clearly outlining acceptable practices. This helps protect the company in case of audits or legal inquiries.

5. Encourage Responsible Spending

By clearly defining what constitutes a reasonable expense, an expense policy encourages employees to make cost-effective decisions, ultimately benefiting the company’s bottom line.

Learn more about the common headaches associated with expense policies.

Key Components of an Expense Policy

When crafting your expense policy, consider including the following key components:

- Purpose: Begin by stating the policy’s purpose and its importance to the organization.

- Scope: Specify who the policy applies to, such as all employees, contractors, or specific departments.

- Expense categories: Clearly define the types of expenses that are reimbursable. Common expense categories include travel, meals, lodging, entertainment, and office supplies.

- Limits on expenses: Establish spending limits for each category. This helps manage expectations and control excessive spending.

- Approval process: Detail the process for obtaining approval for expenses, including any necessary forms or documentation.

- Submission guidelines: Provide clear instructions on how employees should submit their expenses, including timelines, required receipts, and any specific forms to use.

- Reimbursement timeline: Outline the timeline for processing and reimbursing expenses to set employee expectations.

- Consequences of non-compliance: Specify the consequences for submitting false claims or failing to follow the policy, reinforcing the importance of adherence.

Pro Tip: Leverage an Expense Management Platform

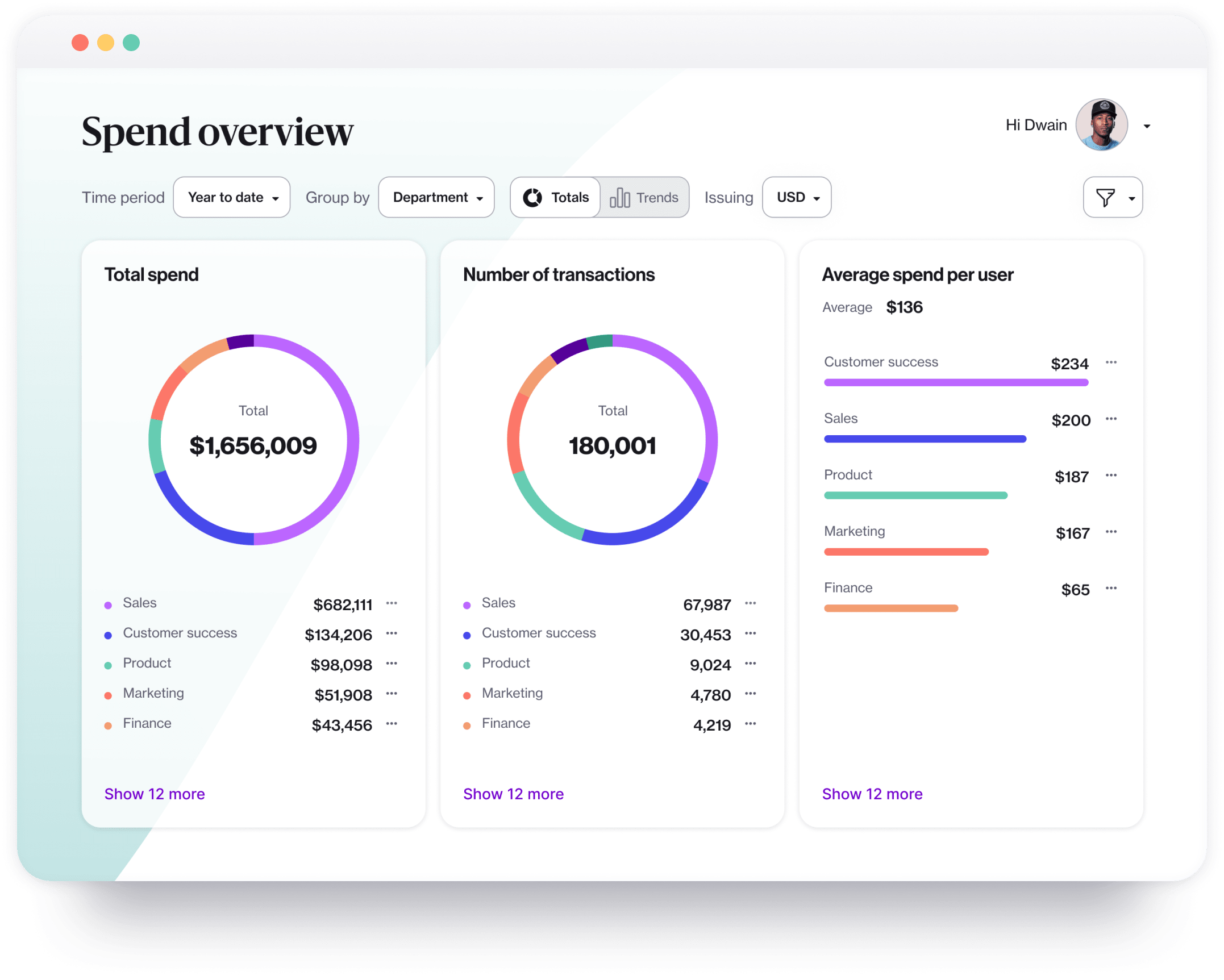

Investing in an expense management platform can transform your organization’s financial processes. By centralizing expense tracking and reporting, companies:

A platform helps foster accountability among employees and enables better financial decision-making, which can lead to cost savings and enhanced efficiency.

Using Our Free Expense Policy Template

To help you get started, we’ve created a comprehensive expense policy template that you can download for free.

This template includes all the key components mentioned above, allowing you to customize it to fit your organization’s needs. Here’s how to use it effectively:

- Download the template: Click the link below to access the free expense policy template.

- Customize the content: Tailor the template to reflect your company’s specific needs, culture, and values. Make sure to adjust categories, limits, and processes to align with your organization’s practices.

- Consult with stakeholders: Share the draft with key stakeholders, including finance, HR, and legal departments, to help ensure that all perspectives are considered and that the policy complies with relevant laws and regulations.

- Communicate the policy: Once finalized, communicate the new expense policy to all employees. Consider holding a meeting or training session to explain the policy and address any questions.

- Review and update regularly: An expense policy should not be static. Regularly review and update the policy to reflect changes in company practices, employee feedback, and legal requirements.

A well-crafted expense policy is essential for managing business expenses effectively. It clarifies employee expectations, encourages responsible spending, and helps ensure regulatory compliance. Our free corporate expense policy template makes it easy to create a tailored policy for your organization.

The Problem with Static Expense Policy Documents

Establishing a comprehensive expense policy is a vital step for any business. However, static expense policy documents can quickly become outdated and challenging to enforce.

Static expense policy documents pose several challenges for everyone involved.

Administrators:

- Time-consuming updates: Manually revising and distributing updated policy documents can be labor-intensive and inefficient.

- Enforcement challenges: Ensuring compliance with static policies requires constant oversight and manual checks, increasing the administrative burden.

- Lack of visibility: Limited access to real-time data makes it difficult to monitor adherence to policies and identify areas for improvement.

Employees:

- Confusion and inconsistency: Outdated documents can lead to confusion about current policies, resulting in inconsistent compliance.

- Limited access: Static documents may not be easily accessible, making it harder for employees to reference policies when needed.

- Inflexibility: Static policies often fail to accommodate unexpected changes or exceptions, leading to frustration and potential non-compliance.

Proactive Dynamic Policies Built into Your Tech Stack

With a modern expense management platform, administrators can build expense policies directly into the software so employees can see the relevant policy rules before making purchases.

Here’s how Navan can simplify expense management:

- Built-in policy controls: Automatically enforce company expense policies within the platform, reducing non-compliance and improving oversight.

- Mobile app: Employees can easily submit expenses on the go, ensuring timely reporting.

- Real-time tracking and reporting: Companies gain instant insights into company spend.

- Automated approval workflows: Reduce manual oversight and streamline the approval process by automating workflows and notifications.

- Third-party integrations: Seamlessly integrate with accounting software like NetSuite, QuickBooks, or Xero for smooth financial management.

- Automate expense reporting: Automate and digitize the entire expense reporting process, eliminating the need for tedious manual reports.

Request a demo to learn how Navan can support your expense management needs.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.