Expense Management Companies vs. DIY Solutions

Expense management is a vital part of a company’s operations and can pave the way to financial success. But, as your company grows, the expense management process becomes more complex.

Whether it’s travel costs, office supplies, or client meals, efficiently tracking and paying for these costs can be tricky. That’s where the big question arises: Should you invest in an expense management company or continue managing expenses internally with a DIY approach?

In this guide, we’ll break down the pros and cons of each approach to help you decide which option best suits your business.

The Importance of Expense Management

Managing expenses efficiently can significantly improve a business’s financial health, no matter its size. When conducted poorly, it can lead to higher costs and an increased workload for the finance team and ultimately damage the company’s long-term financial health.

When it comes to expense management, companies have two choices: handle expense tracking and reporting internally or use specialist expense management solutions offering an automated platform.

Understanding which option best aligns with your company’s needs is a crucial step in making the right choice.

What is a DIY Expense Management Solution?

A DIY solution is a homegrown process that usually pieces together various expense management methods and generally uses spreadsheets, basic accounting software, or paper-based systems. This approach can offer control, but it also requires a more hands-on involvement that demands a lot of time and manual data entry and integrations, which can lead to human error.

Benefits

The most obvious benefit of a DIY solution is cost savings since it generally does not require a company to pay the software subscription costs of a specialist provider. This benefit can be appealing, especially when working with a tight budget.

However, although this solution provides initial cost savings on subscription costs, human errors, and compliance issues will likely lead to more substantial costs in the long run.

Though undoubtedly lacking the advanced features that an expense management company brings, the DIY approach can offer decent customization options. This flexibility can benefit companies with unique expense management requirements or those in niche industries.

However, the customization process can be time-consuming and require specialized technical expertise. Before choosing this approach, it is important to consider whether the business has the resources and expertise necessary to develop and maintain a customized solution.

Drawbacks

What you save in costs, you often lose in time. Manually managing expenses takes up valuable hours that could be spent on more productive tasks. As your business grows, this can quickly become a hindrance.

Manual data entry increases the risk of errors, sometimes leading to inaccurate reports and tax issues. A GBTA (Global Business Travel Association) study found that manual expense reports have an error rate of up to 19%. Fixing these errors can be costly in terms of both time and money.

DIY solutions don’t provide real-time data and analysis, making it harder to track trends and make informed financial decisions. Furthermore, manually extracting and consolidating the data requires more time and effort, which can distract the finance team from focusing on more critical tasks.

What are Expense Management Companies?

Expense management companies offer specialized software to streamline the entire expense process. Modern solutions, like Navan, help businesses improve their expense management by enabling them to record transaction details instantaneously and reconcile expenses automatically.

Benefits

Automation is a key benefit of using a specialist expense management solution. Instead of manually submitting receipts, employees can simply snap a photo, and the system will extract the data necessary to process the expense.

With Navan, all spend made with a credit card connected to the platform or app is immediately recorded, saving time for employees across the company. Automated systems reduce the need for manual data entry and eliminate time-consuming administrative tasks.

Leading expense management companies offer users access to live dashboards, which provide a view of company expenditure. This feature enables companies to recognize spending trends, make better-informed financial decisions, and refine company policies for greater cost efficiencies.

U.S. businesses are subject to strict IRS (Internal Revenue Service) guidelines on expense claims. Companies that fail to comply with these guidelines or any other governmental guidelines can be subjected to hefty penalties. Navan’s platform helps businesses comply with official government guidelines by supporting companies in recording and reporting VAT (value-added tax).

In addition, automation also reduces the risk of errors and fraud, which, when undetected, can cost businesses money.

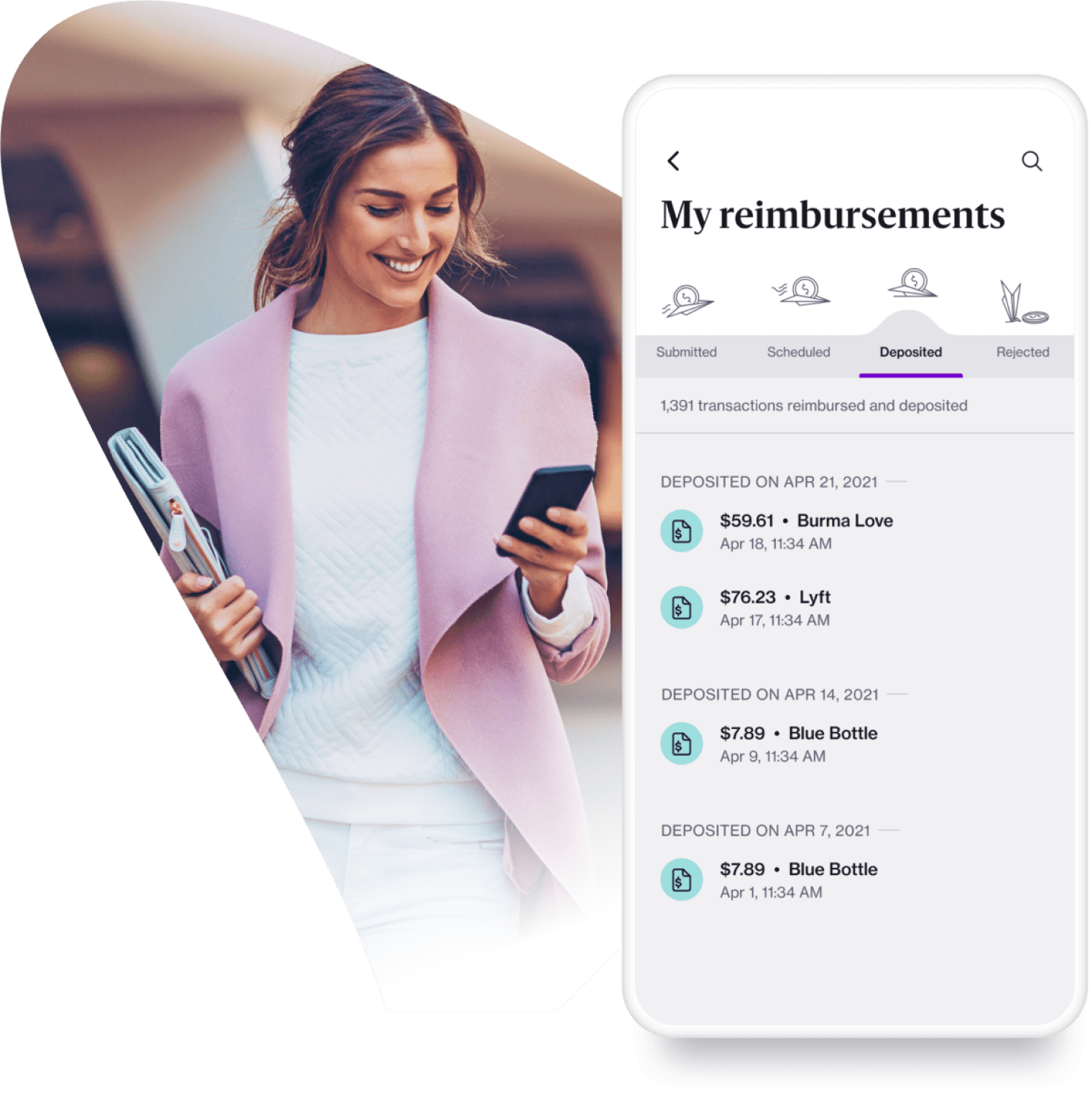

Efficient, user-centric expense management software improves employee satisfaction by removing the need for employees to submit manual expense reports and speeding up the reimbursement process. With Navan, employees can manage expenses easily from their smartphones, improving the user experience.

Drawbacks

A subscription fee is usually required to use the tools and features of an expense management company.

However, the investment quickly pays for itself, given the time and money companies save on expense management when using a software solution. It’s important to consider whether comprehensive features such as automated transaction tracking, company policy enforcement, and integration with existing financial systems can help cut costs and prevent penalties due to non-compliance in the long run.

As with any new system implemented in a company, there can be a learning curve. Employees will learn a new way of submitting expenses, and there may be some growing pains. Thanks to its user-centric and intuitive interface, Navan’s solution has an average adoption rate of 95% among employees.

Which Option Is Best for You?

Choosing between expense management companies and DIY solutions ultimately depends on the size and needs of your business. Here’s a summary to help you make a well-informed decision:

Go With an Expense Management Company if:

- You manage a large team or expect to grow.

- You want to automate as much of the expense process as possible.

- You want to improve compliance and reduce the risk of errors.

- You value time-saving features like real-time insights, swift reconciliation, and mobile access.

Stick to a DIY Solution if:

- You’re a small business with a limited number of transactions.

- You have the time and resources to manage expenses manually.

- You’re looking to save money in the short term.

Final Thoughts: Making the Right Call for Your Business

Choosing between expense management companies and DIY solutions is a nuanced decision that should be made by considering your company’s unique circumstances. For most businesses, the ability to automate processes, reduce human errors, and stay compliant with regulations makes using an expense management solution a smart investment.

Ultimately, it’s about balancing the time and resources available to your business. And remember, the most effective solution is the one that frees up your team’s time to focus on what it does best — driving your business forward.

Book a demo to learn more about how Navan’s expense management solution can help you automate processes, gain valuable insights, and save time and money.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.