Reporting VAT and GST on Expenses with Navan

At Navan, supporting global customers is a top priority. From international points of sale, local currency card issuing and reimbursements to local language support, the Navan team is always striving to build on international capabilities. Today, we are building on that work with the addition of VAT reporting for expenses.

Value-added tax (VAT), also known in some countries as a goods and services tax (GST), is a consumption tax applied throughout the supply chain that exists in more than 170 countries — almost every major country outside of the United States.

VAT is incurred on employee expenses but is recoverable on all sorts of business expenses. While companies are increasingly expanding globally and cost savings are at the top of the priority list, Navan enables companies to accurately report VAT on expenses so they can easily reclaim it.

According to a report from OECD, $20 billion in foreign VAT goes unclaimed each year. This is because VAT reporting and recovery is time-consuming and complex, with different rules by country and poor tax information capture. With Navan, companies can now capture, track, and report on VAT for all expenses outside of prepaid travel — saving time and money across the whole process.

Here’s how it works:

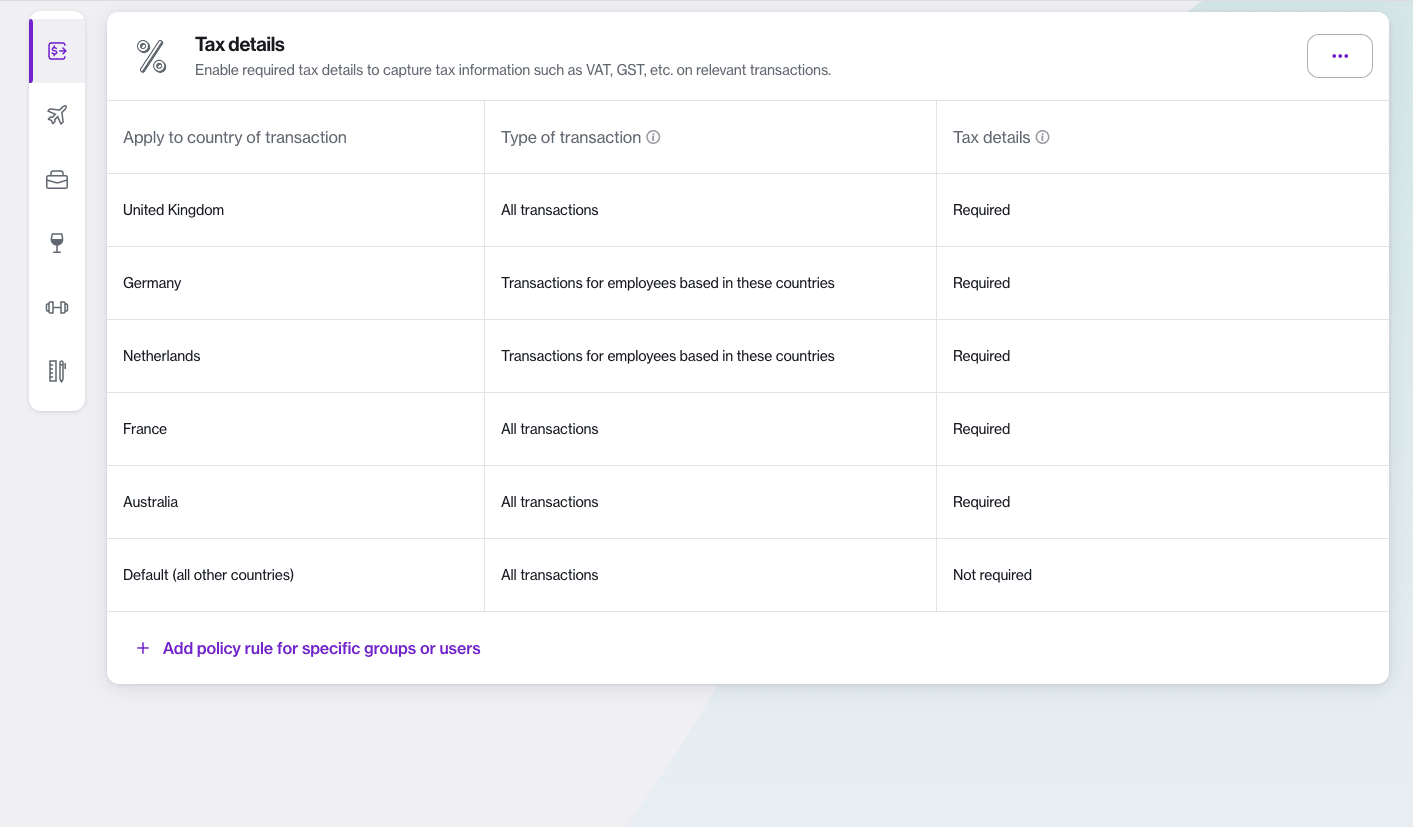

Set tax requirements upfront

Create policies for tax details based on the country of the transaction, type of transaction, and more. Employees will only see the VAT section on their transaction, if required, to input VAT details.

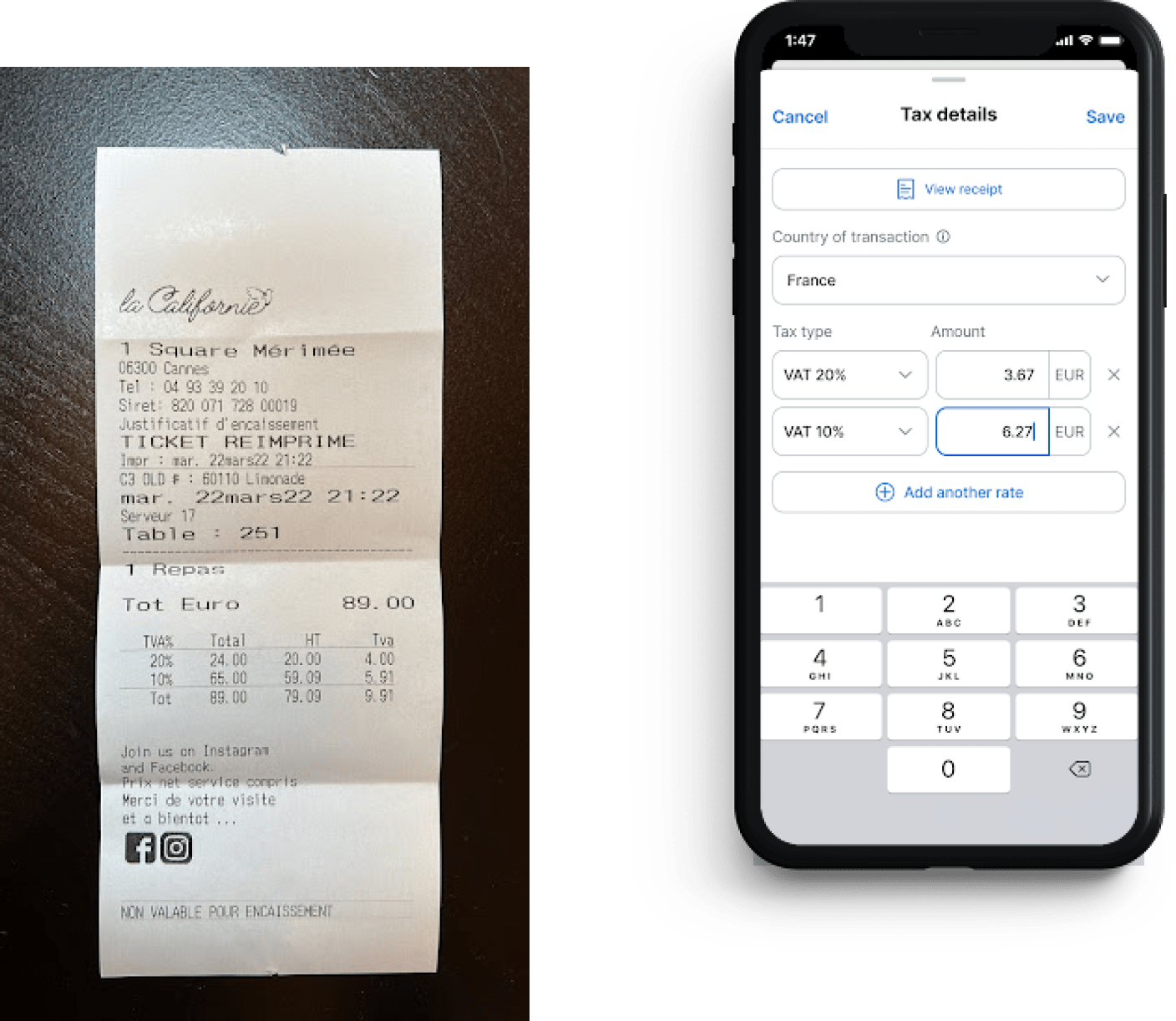

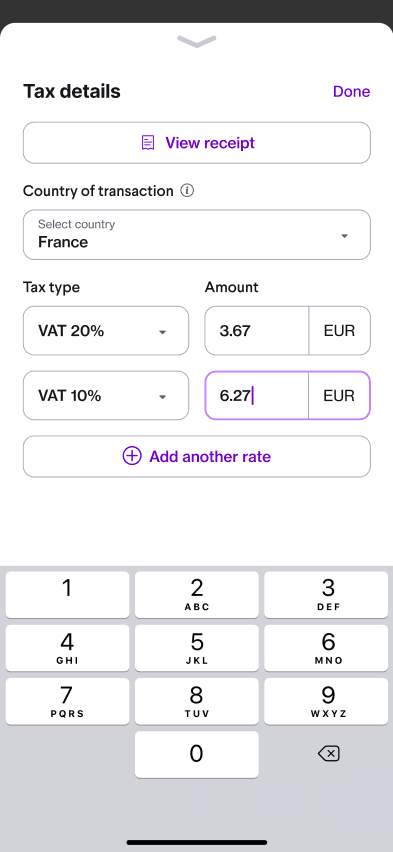

Let OCR automatically populate VAT details

Powered by optical character recognition software (OCR), Navan auto-populates tax details from receipts and allows employees to edit if necessary.

Review and report on tax in real-time

Review and edit the tax details on itemized transactions submitted from employees, and report on them accurately to reclaim VAT.

Learn more about Navan Expense's VAT reporting capabilities

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.