How to deploy a corporate card programme employees want to use

The Navan Team

Most business leaders know: you need to spend money to make money.

As organisations grow, their need to spend only increases, as more employees join the fold and more business opportunities appear. Navan has written quite a bit of content about why managing these expenses is so important.

And one key tool can help make that spending easier. The corporate card offers a flexible means of payment that can track employee spending and collect granular data points across teams and departments. But just because you give a card to every employee doesn’t mean they will use them properly, or at all.

Here’s how to ensure your employees use company cards correctly and efficiently.

Above: a close look at policy controls for entertainment using the Navan app

How corporate cards work: clear controls, clear policies

Processes exist so that business runs smoothly in all parts of a company. As with processes for submitting design edits, booking client meetings, or filing year-end taxes, teams work better when they have a set of guidelines to follow.

The same applies to a corporate card programme. If employees are unaware of how much they can spend, where and when they can spend, and what they can spend on, it creates unnecessary uncertainty. During a business trip, the last thing your employees want to consider is whether their next meal is covered or if they are allowed to get a taxi to the office.

Setting controls and policies reaches a new level of duty of care when both employees and financial leaders can benefit from the peace of mind that company cards offer.

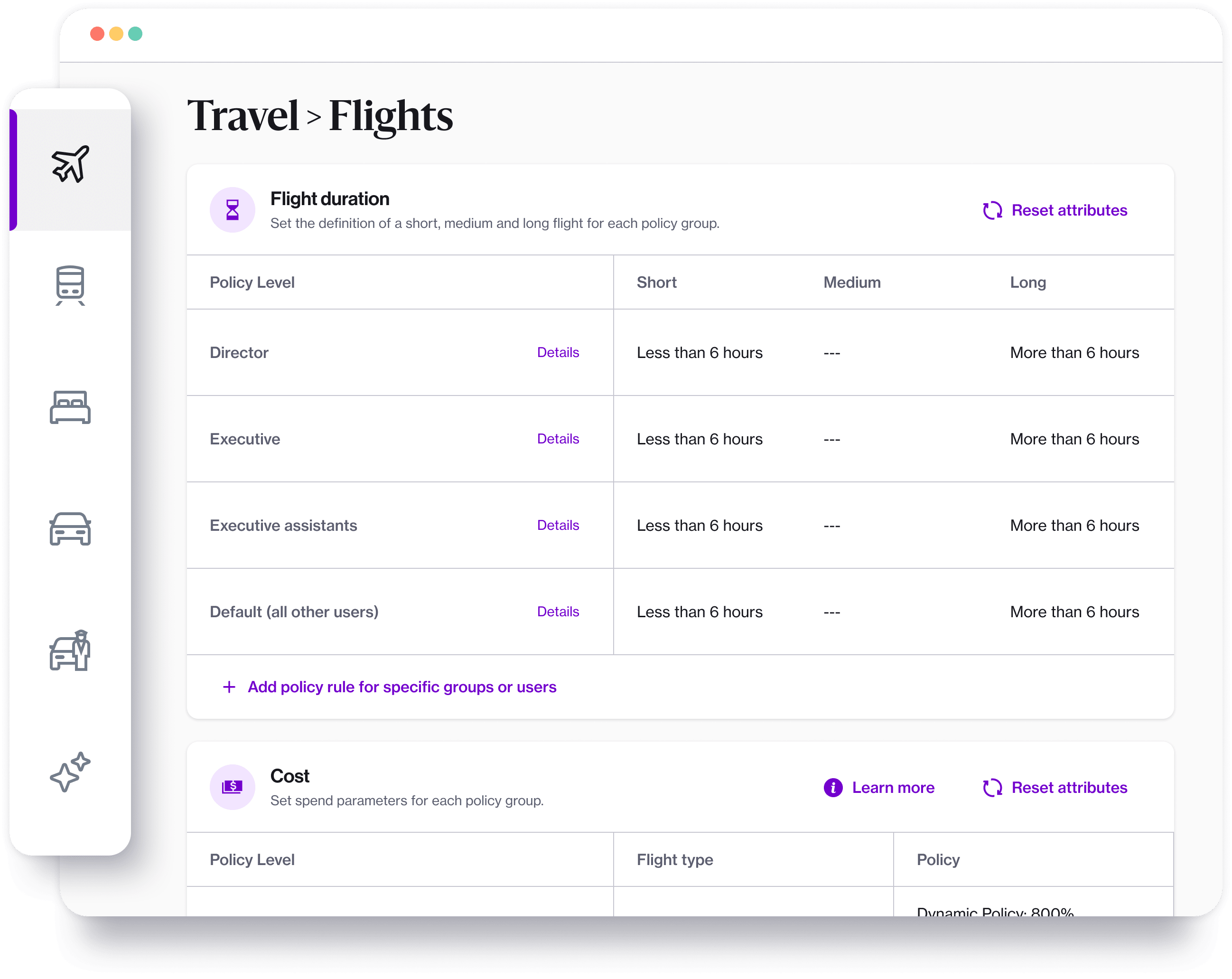

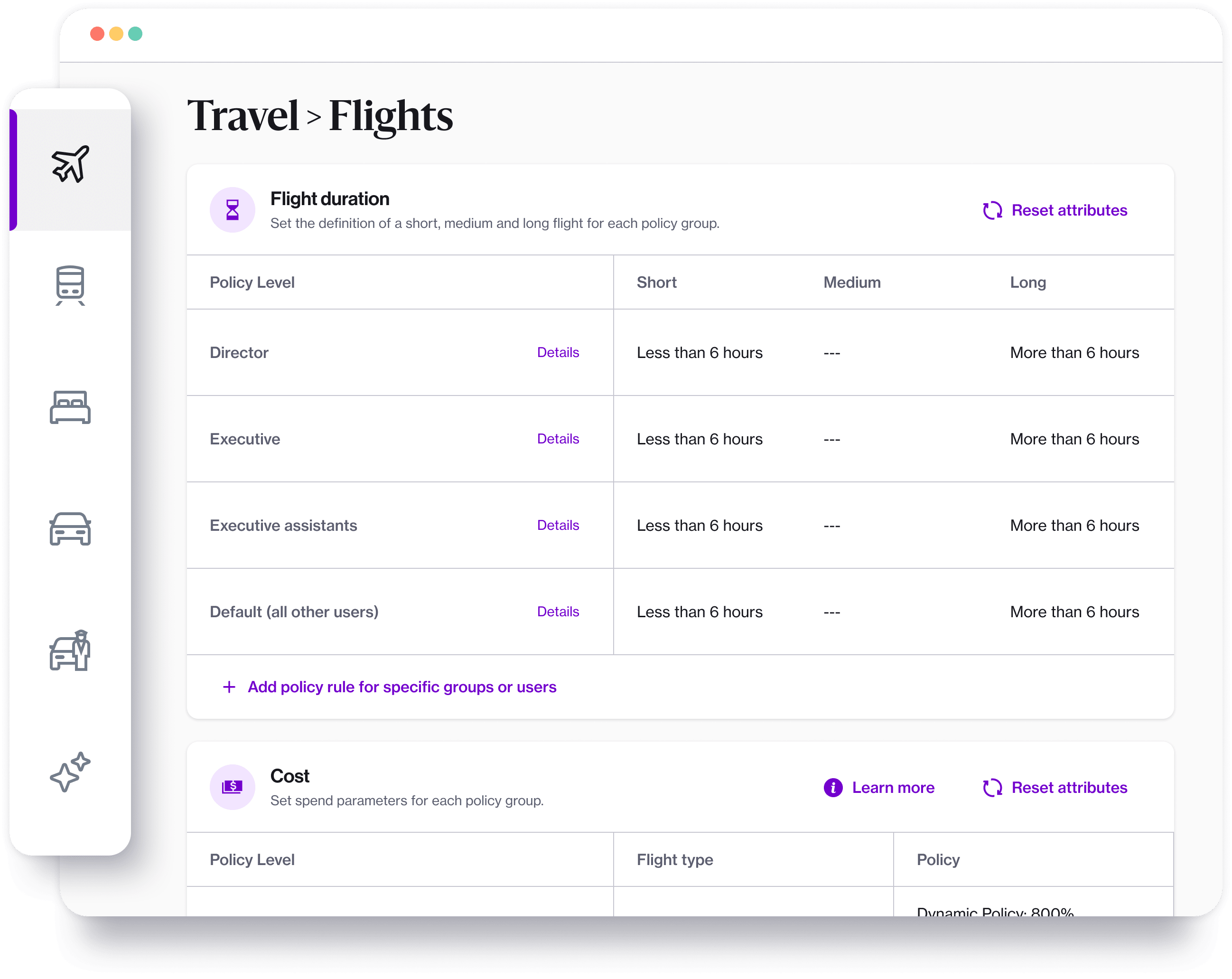

Above: a close look at flight policy settings using the Navan desktop app

The benefits of a corporate card programme

Establish spending limits for company cards

With greater power comes great responsibility, and the same goes for corporate cards. Begin by setting up clear definitions of expense policies, following these guidelines. Then set spending limits for every employee who is offered a physical or virtual copy of the credit card.

What these limits look like will vary and likely change over time as finance teams develop a better understanding of which departments need which funds for which needs.

These spending limits can vary depending on where employees live or operate. A per diem of £50 a day for food and drinks in Belfast, say, will probably go further than in London.

It’s also essential to deploy multiple types of spending limits. For example, you can have a spending limit for each meal and a cumulative limit per week or month. This format ensures that employees spend company money within reason on individual items and on a cumulative basis.

Require approval when necessary

When choosing a corporate credit card programme for your company, it’s imperative to employ one that not only auto-approves the spending limits established in the above section but also allows for flagging expenses, to create more in-depth approval processes.

Manually approving every cup of coffee that comes through the system is obviously tedious and time-consuming. It’s also completely unnecessary. Modern company card solutions can automate many of these transactions, thanks to built-in policy controls. In other words, your finance teams won’t mind when 1,200 employees have access to corporate cards, because the card will do a chunk of the automated work for them.

For larger purchases or transactions that typically fall out of policy, establishing a clear communication channel between admins, managers, and employees can clear up any confusion around appropriate spend amounts. This is where the next element comes into play.

Synergy with expense management systems

With the policies set and in-policy expenses automated, all finance teams need is a way to view all this spend and expedite expense reporting. Because, as Navan and almost every other corporate company knows, no employee actually wants to file an expense report.

In recent years, a shift has occurred from all sides of the company card and expense management equation. Organisations expect better visibility, control, and automation of their spend, and employees expect a digital-first, consumer-like experience.

By attaching an expense management solution to a corporate card programme, those automated expenses are uploaded directly into the expense reporting system for accounting teams to file and code correctly—without an expense report ever touching their desks.

By eliminating expense reports and paper receipts, corporate credit cards also remove the possibility of human error and create more efficient workflows. Automating company card transactions also frees up manager bandwidth and keeps a detailed database of approved and accumulated spend.

Above: A desktop view of a complete expense spend overview using the Navan app

Choosing the right corporate card programme

Just like every company is unique, so is every credit card solution. When looking for a way to make internal processes easier for financial teams, consider these obstacles that company cards can help businesses overcome:

- Lack of control over employee spending

- Time wasted on tedious expense reports

- Limited visibility into real-time expenses

- Slowed processes due to lost receipts and mismatched payments

- Low confidence in the ability to scale

The Navan approach

Not all corporate card systems are built the same. And when it comes to a card that employees want to adopt and use repeatedly, Navan checks all the boxes.

With Navan, companies can combine credit cards with an award-winning expense management solution that covers the entire spend ecosystem, eliminating the manual processes and high transaction fees associated with other card providers.

Additionally, corporate cards tied to the innovative Navan spend management system enable companies to generate more ROI by reducing processing costs, preventing fraud, and providing insightful data that connects revenue to spend.

Companies reap the benefits of automated approvals, corporate smart cards, and streamlined reconciliation. And who will miss expense reports? With Navan, everyone from travelling employees to CFOs will experience the efficiencies that modern expense management offers.

Ready to streamline company spending and implement an all-in-one travel and expense management solution? Schedule a demo to see how our spend solution works.

This content is for informational purposes only. It doesn't necessarily reflect the views of Navan and should not be construed as legal, tax, benefits, financial, accounting, or other advice. If you need specific advice for your business, please consult with an expert, as rules and regulations change regularly.

More content you might like

Take Travel and Expense Further with Navan

Move faster, stay compliant, and save smarter.